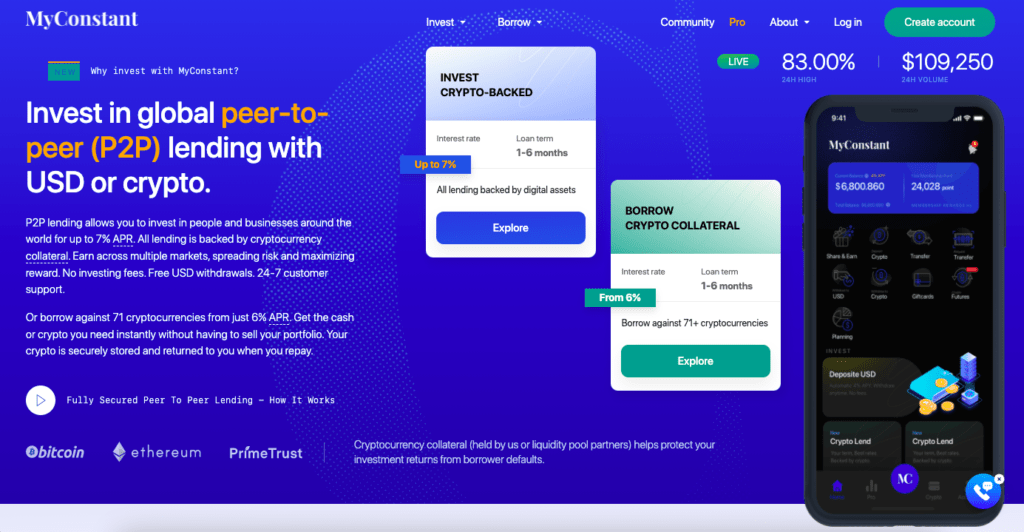

Myconstant is a digital peer-to-peer (p2p) lending platform that leverages the versatility of digital currency to make p2p lending more accessible and offer lenders greater levels of control. All lending is also backed by cryptocurrency capital, offering a measure of protection on funds.

However, p2p lending has its share of issues, so due diligence is required before putting your money to work on this platform.

What is P2P Lending?

P2P lending is the practice of lending individuals or businesses money through services, predominantly online, that match lenders to borrowers.

Essentially, you’ll be lending out your money and making profit on the interest accrued. While p2p loans can offer investors (lenders) annual returns in the ballpark of 7-11%, they are also considered a high risk investment.

A lack of FDIC insurance and security on the loans means borrowers can default, and leave investors SOL. It’s not inconceivable that an unsecured loan could be defaulted on and the lenders would lose 100% of their investment.

Therefore p2p lending has always been a careful balance between risk and reward. However, as the industry grows new digital solutions are being created to address the more gaping issues.

Myconstant: Leveraging the Power of Digital Currency

Myconstant began as a stablecoin (CONST) project back in 2019. To the uninitiated of crypto, stablecoins are digital currencies whose value is linked to an underlying asset, the US dollar in the case of CONST.

Experience in the crypto industry gave the company a different perspective on finance, and they ultimately pursued p2p lending precisely because they believed their digital currency addressed common issues in the p2p industry.

For starters, they saw p2p as being too centralized. P2p lending platforms like Prosper and Lending Club essentially acted as banks, setting rates, evaluating risk, and controlling the lending process. Digital currency like CONST runs on blockchain technology, meaning its decentralized and much more versatile. Myconstant claims this allows them to give lenders unrivaled levels of control over the lending process.

Another issue Myconstant saw in p2p lending was a lack of collateral and, as a result, security. Again, digital currency helps resolve this issue by standing in as collateral for the loans.

Myconstant Products

Instant Access Lending

Myconstant’s most accessible option, and a great choice for beginners who are new to p2p lending and simply want to dip a toe in the water.

Instant access means you will always have access to your funds; they won’t be locked out for a set period of time as with fixed-term. The interest is also paid out in real time, as opposed to at the end of the term.

The trade-off here is that APY for instant access lending is lower than fixed-terms. While fixed-term loans can make anywhere from 6-9% APY, instant access offers 4%.

However, instant access is still a good option to try out in the beginning, and then move into fixed-rate lending as you become more comfortable with the platform.

Fixed-Term Lending with Myconstant

Fixed-term lending offers better rates, but locks the loaned money up for a fixed period of time. This is typically the option taken by those with experience in lending who understand the risk and find it acceptable that their money will be inaccessible for a set period of time.

Myconstant currently has 3 packages for fixed-term lenders, each catering to different demands:

– 6% APY for 30 days

– 7% APY for 60 days

– 9% APY for 180 days

With the fixed-term loans, interest is paid out at the end of the term.

Crypto Lend

For crypto enthusiasts, Myconstant also offers the option to lend directly in crypto and avoid fiat currency altogether.

Crypto lending is a rapidly growing industry, and there are many businesses and individuals in search of crypto capital to drive their entrepreneurial efforts.

Myconstant supports lending for Bitcoin (BTC), Ethereum (ETH), and Binance (BNB) cryptocurrencies, but only with these three. Minimum loans must be at least 0.005 BTC, 0.1 ETH, and 0.01 BNB (around $150 – $200). Maximum loans cap out at 5 BTC worth of any token (currently = $165,000).

Similar to instant access, interest is paid out in real time and your money is accessible at any time.

Myconstant Bonuses

As a new and growing business, Myconstant has several bonuses available to encourage investing your money.

For every deposit equal to or larger than $1,000 investors will receive $15 cashback.

They also offer new US users, 4% APR on a $4000 trial bonus to try out the platform and see how your money grows.

Myconstant also has a strong referral program, offering users 10% of the instant-access investment interest from any accounts they refer.

Myconstant Reviews

Myconstant looks like a great opportunity for anybody interested in p2p investing, and they talk a big game. The question is, can they back it up?

For starters, understand that there are inherent risks with both p2p lending and with cryptocurrency in general. Both are emerging industries, which is why we’re able to see such significant gains. However those gains are balanced by just as much risk, and an understanding of this balance is necessary before putting your money into either.

Internet reviews for Myconstant generally lean towards the positive, with the platform earning a 4.5 star review on Trustpilot across nearly 1,000 reviews. That many positive experiences alone must mean they’re doing something right.

There are some negative reviews, but most seem to be cases of transfer issues which seem to occur case-by-case and not as a consistently trending issue. I’d be pissed too if my money had trouble coming in, but if it only happens to 10 people in 1,000 then it’s not much to worry about. We all got vaccinated, right?

One area the reviews indicate the company excels in is customer service, and it seems like the platform goes above and beyond to help their users get started in p2p lending.

Their customer service line is also open 24/7, which is a big plus for an online platform with potential customers from a multitude of timezones (and a big advantage over traditional banks which close at like…2:00pm)

Final Thoughts

P2p lending can be risky, but a balanced investment portfolio should honestly have a bit of risk. Gotta risk it for the biscuit!

By leveraging the exciting new opportunities available with digital currencies, Myconstant does cut a bit of the risk (not all of it) from p2p lending and makes it more accessible than ever before.

If you’re looking for a new investment vehicle and can stomach a bit of risk, this might be exactly what you’re looking for!