The US pandemic response spawned a Hunger Games style mask market where international governments and agencies slug it out to get life saving gear like masks, gowns, and shields for doctors.

States have publicly complained about being forced to bid against each other to secure gear with unit costs of less than $1. Even ordered gear is not safe, with rumors of FEMA seizing shipments around the country. In Miami, a firefighting department denounced the federal government for hijacking 1 million N95 masks, though FEMA stated that they are not intervening with legitimate suppliers.

So what happened? Why did an item that used to be less than a $1 retail suddenly become one of the hottest commodities in the globe?

Mask Production In China

China is the world’s largest producer of masks. In response to the coronavirus outbreak, factories were commandeered by the Chinese government to produce personal protective equipment in January.

China multiplied its mask manufacturing capacity over 5x by the end of February from 20 million masks/day to 110 million/day. Around March the outbreak in Hubei province was largely contained. Conditions were ripe for global export just as the pandemic was spreading in Europe and the US.

Material Shortages

What’s difficult about making a mask? Medical grade surgical masks and Filtering Face Respirators (FFR) all use melt blown fabric as a filtration layer. Production of this layer requires significant capital investment and expertise that can’t be replicated overnight.

Typically the price of melt blown fabric is 20,000 yuan/ton. At the height of shortages prices exploded to 700,000 yuan/ ton in April, before resetting to around 400,000 yuan/ton。

Seller’s Market

In a typical market, buyers assume they have the right to ask for a pricing upfront. If you go directly to any factory right now, especially if it’s a cold call without a relationship, they will ask first for a purchase order.

Overwhelmed by orders, there’s no time for dealing with inquiries. Pricing lists are hard to come by if factories can’t confirm buyers are serious.

Too Many Brokers

Not only that, but because the number of brokers has also grown, the number of inquiries has multiplied. Consider this – a US state puts out a bid for equipment, which gets picked up by suppliers, who are sourcing from additional suppliers to be able to meet demand, who may have to source from others who have a relationship, who may even have to add another person in the middle with Chinese proficiency.

When there are several middlemen, there is multiplicative effect. Say that chain of suppliers becomes 3 levels deep, and if each person in that chain tries to compare pricing among 3 provider. By the time it gets to the factory level, the original demand has been multiplied to 27 times. Any additional layer of brokers has an order of magnitude increase in the perceived demand.

Minimum Order Quantities

To combat the flood of requests, factories have also increased their minimum order quantities and reduced the level of service for smaller inquiries. While there’s no hard and fast threshold, MOQs would still be on the order of a few hundred thousand dollars, while orders for millions of dollars of masks continue to flood the market.

California announced a billion dollar order to supply 200 million masks per month to the state.

On the demand side of the equation, there are even more smaller buyers in the marketplace. Hospitals, clinics, and even small businesses have PPE needs now in smaller quantities.

This mismatch needs to be made up by additional retail suppliers stepping in. This is a gap Amazon has often traditionally filled, but due to shortages they are trying to direct all PPE supplies through their COVID marketplace prioritized for the frontline.

Shipping

Shipping routes have been severely disrupted as 95% of flights worldwide have been grounded. Passenger flights used to haul around half of the world’s cargo, and that stoppage has created bottlenecks causing shipping prices to skyrocket.

From March to April alone, the price of shipping from China to the US doubled, and continues to change every day. Shipping prices can no longer be quoted within price, and literally cannot be calculated until the goods are paid for, boxed, and about to be shipped off.

Suppliers have to account for this by building higher margin into prices, or quoting ex-factory prices, meaning pricing is quoted from the factory location. The buyer is responsible for any shipping, customs/duties.

The upside is that buyer pay exactly what the shipping charges come out to be, but most purchasing departments want to know what the bill will be before it comes. The downside is that when a supplier in the middle is taking on the risk of increasing shipping prices, the price quoted to the end buyer is going to be higher than it probably needs to be.

Chartering private jets has become much more commonplace, like when Massachusetts borrowed the New England Patriots plane though that doesn’t always speed up the transaction. Private jets costing $1.4 million still had a 1-2 week backlog in early May.

Verification

Buyers ask for verification of the goods before buying, like pictures or videos of the goods. Yet if dealing with manufacturers directly, many manufacturers are refusing. Some of it has to do with fake videos and pictures circulating, which has plagued brand name manufacturers like 3M. Otherwise there’s also no time for that service. There are plenty of other buyers.

Even if you do get pictures or videos, it’s not easy to question their authenticity.

Prepayment

On the NPR podcast Planet Money “The Mask Mover” episode, they tell a story about the state of Illinois comptroller (who looks after finances) physically drove a $3 million dollar check to a new supplier.

Production won’t start unless money is received by the factory. There’s just not enough capacity for people to hold large orders. So cash upfront is required, often 100% for small orders, or 50% for larger ones. And the goods will not be shipped until 100% of the order paid for.

This holds true for the vast majority of private market participants. Governments may be able to at least put up 50% of the cash before production instead of 100%. There’s no chance of that for smaller orders. Even shipping costs may be required in some cases, even before the billing amount is confirmed.

Differing Mask Standards

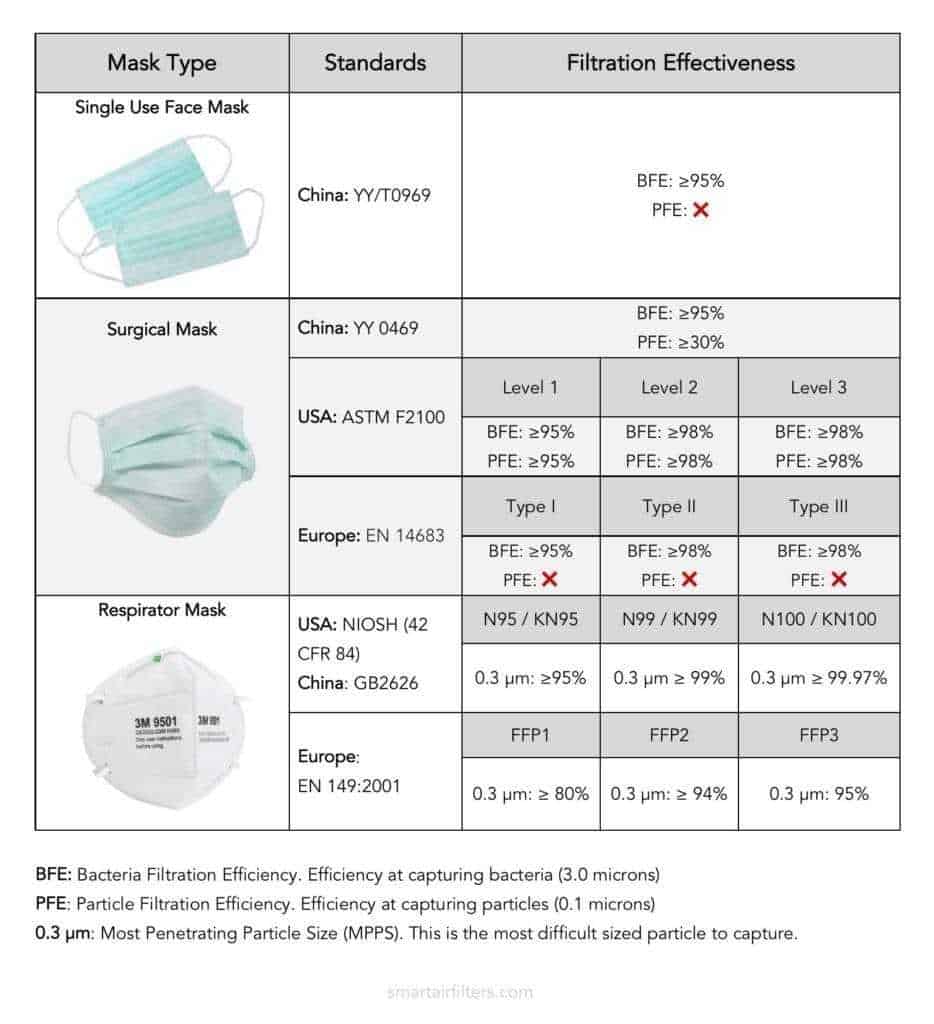

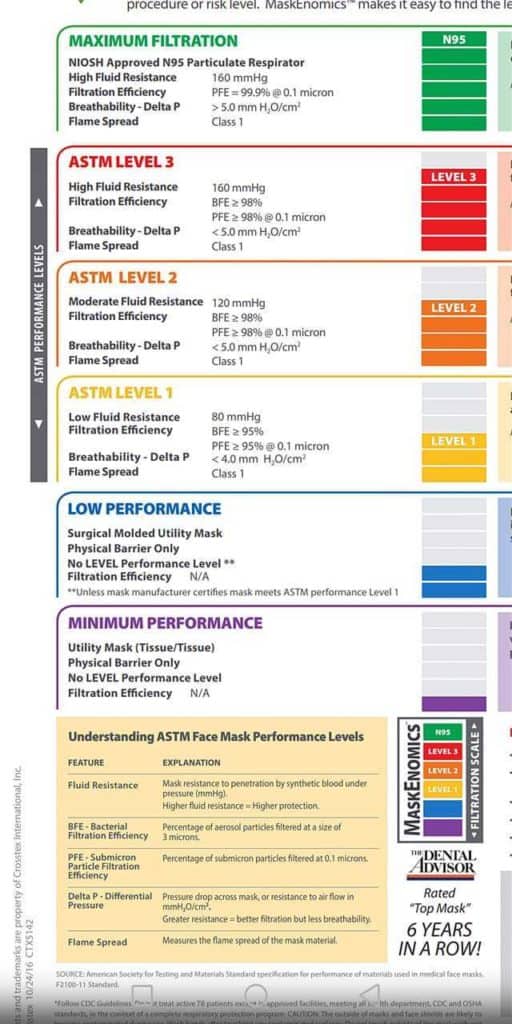

Reconciling different standards between countries can be a headache. The standard technical specifications masks are based around bacterial filtration efficiency, particle filtration efficiency, and fluid resistance.

Accordingly, each country has developed differing standards for both medical and civilian/regular use. Even colloquial terminology differs here. For example in the US civilians typically think of 3 ply masks as surgical masks, perhaps because there’s not much usage of masks outside of the medical or industrial setting. However in China there are well known distinctions between civilian and higher grade surgical masks.

Lack of Comfort With Other Standards

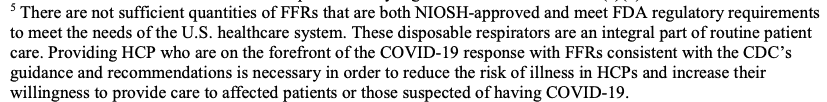

In conjunction with reconciling those standards comes a lack of comfort with standards from other countries. NIOSH approved masks are specifically a US federally approved standard, which narrows the list of eligible masks for importation. While it’s understandable that healthcare workers can and should demand the highest quality masks, getting a mask approved by federal agencies takes time, and also not an undertaking busy Chinese manufacturers may care to do, when they are getting plenty of orders.

The FDA itself noted the following, that there are not enough NIOSH and FDA regulated masks to meet the needs of the US healthcare system.

Language Barrier

Changing regulations require constant upkeep with the rules in order to comply. Starting April 1 China began tightening border controls to minimize the export of faulty masks. The requirements kept changing with new guidelines for medical masks as well as civilian masks produced regularly.

Without Chinese proficiency it’s very hardto keep up.

Even in the US misinformation was constantly spread about mask importation, even from prominent news outlets. The reporting of an FDA ban on KN95s was pure misinformation. We were in direct contact with the FDA, which repeatedly said they don’t object to the importation.

Removing masks from a whitelist does not constitute a ban, especially since the FDA laid out other criteria that would allow the importation of KN95s.

Within the Chinese media we saw news spread about the supposed US ban as well, erecting another barrier for the motivation to do business with the US.

Supplier Secrecy

Often when sending out supplier verification documents, like an FDA or EU registration, the documents are redacted to obscure the manufacturer name.

To most this seems to be a first sign of fraud. Why is there white-out over the manufacturer’s name?

For new buyers, regulated agency verifications was an important part of the process. However the FDA does not issue official approval letters, so registration is verified by third party issued certificates that all look different. As a result, some buyers have reported fake certificates.

FDA registration can be verified on their website, which should really be the only reliable source.

Trust Doesn’t Scale

In the beginning when I was working with a trusted Chinese partner to source goods, I suggested buying a small amount from my supply network.

“I’m not going to buy from your supplier,” declared my friend, someone with whom I’ve had a personal relationship for years, and traveled together.

We were both dealing with suppliers that had all the certifications and lab reports, yet the inherent trust that comes from existing longstanding relationship just does not extend well.

The supplier I’d suggested was a publicly listed company that a US state government is also purchasing from. Even so, my local connect was hesitant to divulge this to anyone besides me, because they wanted to protect that information.

What may be required for transparency to Americans is one of the most valuable assets to a supplier. China’s a nation of hard working hustlers. If one person doesn’t get the deal done, there are 10 others lined up to try to land the deal.

If sourcing information is shared without an order in hand, suppliers run the risk of having end buyers go around them. After all a broker’s value is in having sourced and vetted the manufacturer.

From the buyer’s perspective, how on earth would you trust a seller who won’t divulge the manufacturer upfront?

Obviously this shouldn’t be an issue for long standing relationships, but for newer supply relationships this can be a hurdle.

Is It Over Yet?

It’s now almost July and some containers with larger shipments of masks should have landed in the US by now. But there are still not enough masks and critical shortages of other types of PPE like gowns and disinfectant.

Private citizens have jumped into the fray to help, with organizations like Masksfordocs, GetusPPE, DonatePPE, and Project N95 all trying to coordinate donations. The efforts have had to be localized to be effective.

My funds raised for PPE donation, both public and private, have reached $27k and we’ve been donating masks, gloves, and gowns around the country. Unfortunately, those I’ve spoken to recently still say they are in need. With businesses reopening and cases rising, and no sign of a vaccine, most expect PPE needs to continue to grow.

The Outlook

The Chinese trade war hasnt let up and there’s no political cover to coordinate more distribution from there. Shipping costs continue to be expensive, and clinics, nursing homes, and other essential businesses still struggle to piece together large enough wholesale orders, having to solve their problems alone. Many eventually give up. Even though domestic production has ramped up it looks unlikely to be able to fill the gap.

For every overreaction, there’s an equal and opposite reaction. The intensified interest will eventually lead to overcapacity in China and falling prices. Those that got in too late will go out of business and hopefully, the protective equipment that saves lives becomes reasonable priced again.