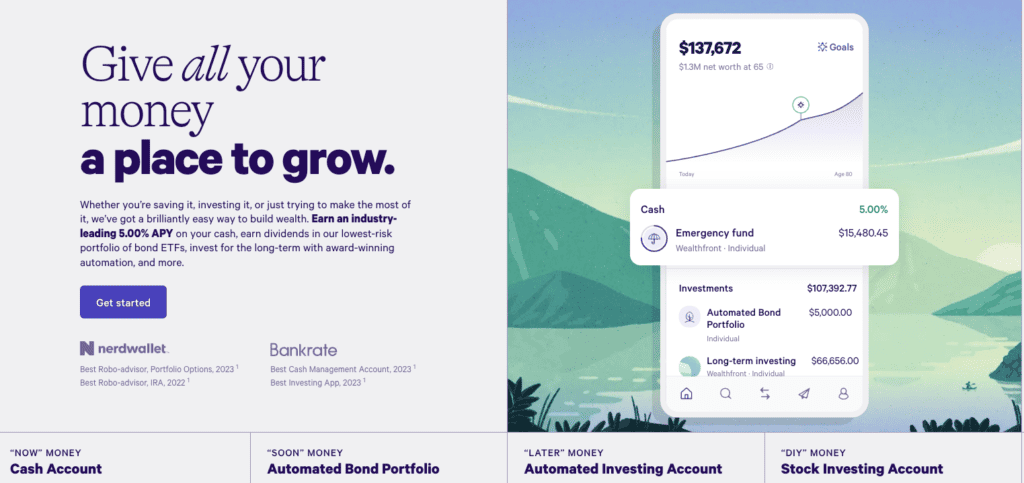

Think of Wealthfront as your very own financial genie, housed within a sleek digital bottle. It’s a trusty, savvy sidekick to help you save, invest, and grow your money. With Wealthfront, you can earn better interest on your cash, choose a diverse and balanced stock and bond mix, and even invest in individual stocks. It offers a veritable buffet of financial options, and the powerful features make budgeting a breeze. With pricing that won’t break the bank, Wealthfront may be the next best thing to having a financial advisor in your pocket. Our Wealthfront review will walk you through the unique pros and cons.

What is Wealthfront?

Wealthfront is a robo-advisor that offers personalized advice and recommendations to help you optimize your finances. With Wealthfront, you can choose from various account types, such as Cash, Bond, or Stock, and benefit from low fees, tax advantages, and data-driven insights. Wealthfront also provides retirement planning, college savings, home buying, borrowing, and other financial services.

How does Wealthfront work?

Wealthfront is a one-stop shop for all your investment needs. Simply answer a few questions about your financial situation, goals, and risk tolerance, and Wealthfront will provide personalized investment recommendations. With as little as $1, you can easily link your bank account and fund your Wealthfront cash account. From there, Wealthfront will automatically invest your money in a portfolio tailored to your needs, whether it’s low-cost index funds, bond ETFs, or individual stocks. Plus, Wealthfront will monitor and rebalance your portfolio, harvest tax losses, and adjust your strategy as needed. Easy access to your account through the Wealthfront app or website lets you track your progress, performance, and projections like a pro.

Wealthfront Pricing: How much does Wealthfront cost?

Wealthfront charges a 0.25% annual advisory fee (deducted monthly) on all its automated investing account types. The annual advisory fee does not include the expense ratios of the underlying funds and ETFs, which average between 0.05-0.29%. The Cash Account has no fees, and there are also no fees for trading(commission), account opening, withdrawal, account transfers, and account closing.

Wealthfront Review: Where Wealthfront shines

No Wealthfront review would be complete without discussing a lineup of its features to rattle the competition.

High-Yield Cash Account

The Wealthfront Cash Account is your ticket to taking advantage of high interest rates and earn on your cash. With a whopping 5.00% APY, you can watch your savings grow while you lounge around. This savings account has no pesky account fees, minimum or maximum balance, or unlimited transfers. Plus, your cash is protected by up to $8 million in FDIC insurance through partner banks. It’s the perfect place to stash your daily expenses, emergency fund, or short-term savings until you’re ready to invest. And if you’re feeling adventurous, you can easily transfer your cash to other Wealthfront accounts, like the Bond or Stock Investing Account, and start earning even more on your money.

Automated Bond Portfolio

Wealthfront’s Automated Bond Portfolio is a low-risk, high-yield investment option designed to earn more than the Cash Account sans the volatility of high-risk investments. The portfolio invests your money in a diversified range of bond ETFs that track the performance of various bond markets, such as corporate, municipal, or treasury bonds. These ETFs are carefully selected and weighted based on your risk profile, tax situation, and time horizon.

The Automated Bond Portfolio benefits from Wealthfront’s automated features like reinvestment, rebalancing, and tax optimization, so you can sit back and relax while your money grows. This option is perfect if you’re saving for big purchases like a car, a vacation, or even a wedding and looking at a time frame of 1-3 years.

Automated Investing Account

The Wealthfront Automated Investing Account is the real deal and the go-to choice for many long-term investors. It invests your money across a variety of index funds that mirror different stock and bond markets globally. Your risk score guides the selection and weighting of these funds, ensuring they align with your comfort level and risk tolerance.

What sets this account apart are its extra perks. Tax-Loss Harvesting helps optimize your after-tax returns by strategically managing investments. Smart Beta adds an extra layer of finesse by considering factors beyond market size, and Risk Parity smartly juggles asset classes to improve risk-adjusted returns. It’s the ideal tool for those aiming toward distant goals like retirement, education, or buying an island in the sun-kissed tropics of the Caribbean.

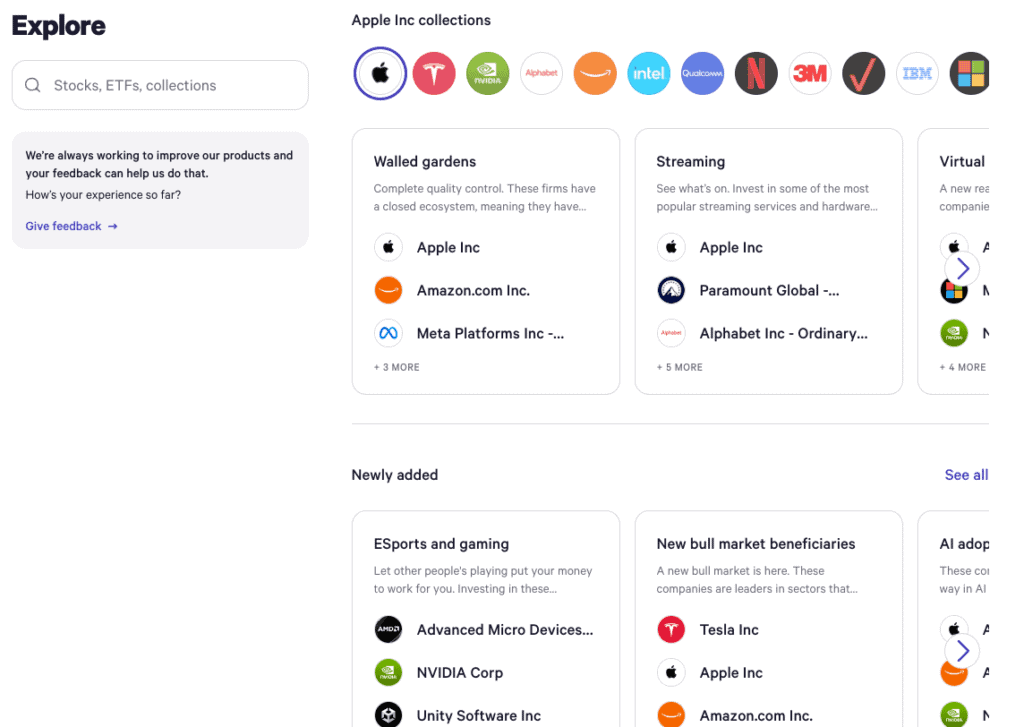

Stock Investing Account

Wealthfront’s Stock Investing Account is a new feature for buying individual stocks and ETFs, and it has a unique selling point: no commissions or trading fees. Unlike its Automated Investing Account sibling, it gives you more control and flexibility over your investments while still providing Wealthfront’s expert guidance.

With dozens of stock collections based on themes, sectors, trends, or opportunities, you can find the perfect match for your investment needs. You can easily evaluate the growth potential, valuation, dividend yield, and analyst ratings of each stock or ETF, or simply create your custom portfolio or follow the portfolios of other Wealthfront users, including experts, influencers, or friends. The Stock Investing Account is ideal for investors willing to take more risks, pursue higher returns, or have a particular interest or passion for specific stocks or ETFs. You can also explore collections that aggregate stocks according to themes.

Path Financial Planning

Wealthfront’s Path Financial Planning is a powerful and intuitive tool that helps you plan for your financial future. Covering a range of financial aspects such as retirement, college, home, travel, and more, Path Financial Planning lets you link external accounts like your bank, employer, and student loans to give you a clear picture of your net worth, income, expenses, and savings. You can set your goals, and the tool will assess your likelihood of achieving them based on your current and projected situation.

With personalized advice and recommendations on saving, investing, and optimizing your taxes, Path Financial Planning is a must-have for anyone looking to make smarter and wiser financial decisions. And the best part? It’s available for free to all Wealthfront users.

Portfolio Line of Credit

Borrow up to 30% of the value of your Automated Investing Account without the hassle of applications, credit checks, or monthly payments. You can request a loan anytime through the user-friendly Wealthfront app or website, and the money will be in your bank account within one business day to use as you please. The Portfolio Line of Credit charges a variable interest rate as low as 7.65%, which is generally lower than other borrowing options like credit cards, personal loans, or home equity loans. A flexible and convenient option, the Portfolio Line of Credit allows you to access cash without disrupting your long-term investment strategy.

Performance

In the Robo Report by Condor Capital, Wealthfront ranks 2nd for three and five year total performance among 50 robo-advisors. Of course, past performance does not guarantee future results.

Where Wealthfront falls short

Wealthfront is an excellent choice for investors; however, a few drawbacks are worth noting before opening an account.

No human financial advisors.

Wealthfront’s automated platform may not be everyone’s cup of tea since it doesn’t offer direct access to human financial advisors. If you prefer having a more personal relationship with a financial professional who can give you tailored advice, you may want to check out robo-advisors like Betterment or Personal Capital, which offer hybrid models. If you feel a bit more extravagant, you can go for traditional financial advisors that provide more personalized services.

Not the lowest minimum

Wealthfront isn’t the cheapest date in town. You’ll need a minimum of $500 to open an automated investing account, which is more than some of its competitors, like Acorns or SoFi, that don’t require any minimum.

No live chat

Wealthfront’s customer support options are limited, with no live chat available. Wealthfront’s phone support is only available during weekdays from 7 am to 5 pm PT, so you may need to plan ahead if you want to contact them.

Difficult to connect with a live product specialist.

Wealthfront claims to have a team of product specialists who can answer your questions, but getting in touch with them could take longer than waiting for your favorite TV show’s new season.

Who should use Wealthfront?

Wealthfront is best for investors:

- Who want a low-cost, automated, and diversified portfolio that is optimized for taxes and aligned with their goals.

- Who are comfortable with a digital-only platform that does not offer human financial advisors or live chat support.

- Who are interested in investing in individual stocks, crypto funds, or socially responsible investing as part of their portfolio.

Who shouldn’t use Wealthfront?

Wealthfront is bad for investors:

- Who prefer to have a human financial advisor who can provide personalized advice and guidance.

- Who value fast and convenient customer service and want access to live chat support.

- Who want more control and customization over their portfolio composition and selection of assets.

How to Open a Wealthfront Account

To open a Wealthfront account, you need to follow these steps:

- Visit the Wealthfront website and click on “Get Started”.

- Answer a few questions about your age, income, net worth, risk tolerance, and financial goals. Wealthfront will use this information to recommend a portfolio for you.

- Review your recommended portfolio and adjust your risk score if you want to change the allocation of stocks and bonds. Add individual stocks, crypto funds, or socially responsible investing to your portfolio.

- Create an account by providing your name, email, phone number, and password. You can also link your existing bank accounts to Wealthfront to see your financial picture and track your progress.

- Fund your account by transferring money from your linked bank account. You need to deposit at least $500 to start investing with Wealthfront.

- Sit back and relax as Wealthfront manages your portfolio for you. You can monitor your account performance, adjust your settings, and access various features and tools on the Wealthfront website or mobile app.

Deposits minimums

- Cash Account – $1

- Investment Account – $500.

- US Direct Indexing (Stock-level tax Tax-loss harvesting) – $100,000

- Risk Parity Fund – $100,000

Account types

Wealthfront offers the following taxable and tax advantaged account types:

- Individual taxable accounts

- Joint taxable accounts

- Trust accounts

- Traditional IRAs

- Roth IRAs

- SEP IRAs

- 401(k) rollovers

- 529 college savings plans

- High-yield cash accounts

How does Wealthfront compare?

Wealthfront vs. Betterment

If you’re someone who wants a bit more hand-holding, Betterment is the way to go. They offer low-cost, diversified investment portfolios, tax-optimized strategies, and access to human financial advisors. Plus, you don’t need a minimum amount to open an account. Just be prepared to pay a higher fee if you want unlimited access to financial advisors.

Betterment also offers more portfolio customization options, such as smart beta, income, and flexible portfolios. But if you’re comfortable with a digital-only platform and want to invest in individual stocks, crypto funds, or socially responsible investing, Wealthfront is a great choice.

Wealthfront vs. Acorns

Acorns is perfect for those who want to dip their toes in the investment world without breaking the bank. With a simple round-up feature and a few pre-built portfolios, you can invest your spare change and watch it grow. And hey, if you’re feeling lucky, you can even sign up for their cash-back program and earn some more.

On the other hand, if you’re serious about investing and want a more sophisticated portfolio with tax-efficient features, Wealthfront might be the way to go. They charge lower fees as a percentage of your assets, so you can keep more of your hard-earned money.

Wealthfront vs. M1 Finance

M1 Finance: the robo-advisor that’s got automation and customization down to a science. With M1, you can create your own portfolio or choose from over 80 expertly curated ones. No minimums, no management fees, and loads of features like fractional shares, automatic rebalancing, tax minimization, and even a line of credit. It’s like having a personal finance assistant without the annoying coffee runs.

If you want total control over your portfolio and a fee-free experience, M1 Finance is your go-to. But if you’re the “set it and forget it” type and want access to additional features like individual stocks, crypto funds, or socially responsible investing, Wealthfront may be more your style.

Wealthfront Review: Stash Cash or Invest Passively

Wealthfront is a robo-advisor that helps investors invest in stocks, bonds, and crypto funds in a low-cost, diversified, and tax-efficient way. It’s like having a financial advisor but without the fancy suits and awkward small talk. If you prefer automated investment management and don’t require human guidance, Wealthfront is an excellent option. However, remember it’s not perfect – you won’t find live chat support. On the bright side, you can access individual stocks and crypto funds with enough money in your account. So, if you’re looking for a simple and convenient way to invest, Wealthfront is definitely worth considering.

FAQs

Q: How does Wealthfront invest my money?

A: Wealthfront’s robo-advisor allocates your portfolio based on your risk profile, goals, and preferences. It also optimizes returns by tax-loss harvesting, automatic rebalancing, and smart beta.

Q: How safe is Wealthfront?

A: Wealthfront is a SEC registered investment adviser that follows rules and regulations to protect its clients. It uses bank-level encryption and security measures to safeguard clients’ information. Wealthfront’s accounts are insured by SIPC up to $500,000 per account type, covering losses due to fraud or theft, but not market fluctuations.

Q: How do I withdraw money from Wealthfront?

A: To withdraw money from your Wealthfront account, log in and click on the “Transfer” tab. Then, select the amount and destination for your withdrawal. While Wealthfront does not charge any fees or penalties for withdrawals, there may be taxes or other consequences depending on the type of account and the withdrawal amount. It typically takes one to three business days for Wealthfront to process withdrawals; however, the processing time may be longer depending on market conditions or other factors.