The world of investing can be confusing, particularly if you are just getting started. You want to look for investments based on your risk tolerance that can generate consistent returns over time. Sorting through the overwhelming number of mutual funds to find the best fit can be a monumental task.

If you’ve done some research, you have probably heard about Vanguard 500 Index Fund Admiral Shares (VFIAX) and Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX), which are both index funds. Let’s discuss these two funds in detail so that you can decide if either of these funds are right for you, and if so, which one.

Why Index Funds

Index funds are designed to track a market index and usually contain the stocks or bonds within that index. Instead of being actively managed funds, these funds track indices that are put together according to designated parameters. ‘

Index funds have the following benefits:

· Index funds have generally outperformed other mutual funds in the long-term.

· The funds have low fees.

· They generate less taxable income.

· The fund portfolios are very diversified, so they carry less risk.

Warren Buffet told shareholders “When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients. Both large and small investors should stick with low-cost index funds.”

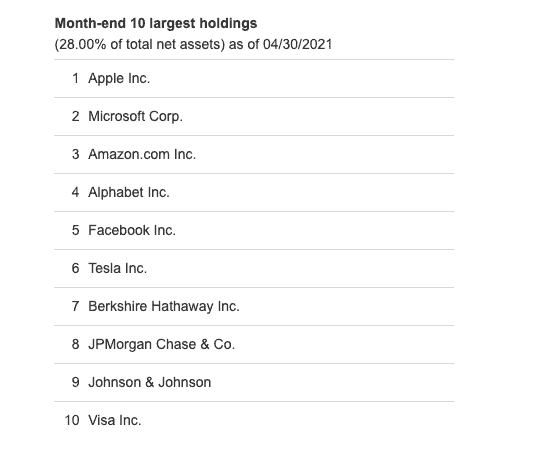

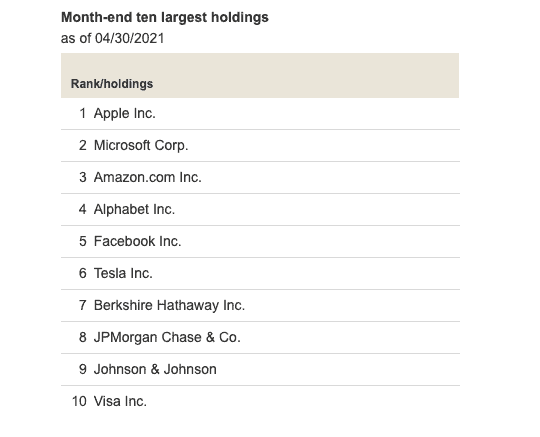

VFIAX is an index fund that tracks the market-cap weighted S&P 500 index and is composed of 509 large-cap stocks. VTSAX is a mutual index fund that tracks the entire stock market, and is composed of 3637 small, mid, and large-cap stocks. All of the stocks in VFIAX are also in VTSAX.

Let’s look at each in more depth.

VFIAX Basics

VFIAX as a fund offers investors the opportunity to invest in large-cap stocks that are subject to the S&P 500 criteria. S&P 500 companies are required to be highly liquid and profitable, and they represent about 80% of the total market capitalization of the U.S. equity market. Here are some facts about VFIAX:

- It has an expense ratio of .04% making it one of the least expensive ways to invest in the S&P 500 index.

- The dividend yield is 1.93%

- The minimum investment amount is $3,000

- The fund has 509 stocks rather than the 500 in the S&P 500 because some companies have more than one class of stock, so VFIAX is an opportunity to invest in the 509 largest stocks in the country.

VFIAX is also offered as an Exchange Traded Fund (ETF), which is more flexible to trade. It can be traded at any time, as opposed to a mutual fund that can only be priced and sold at the end of each trading day.

VTSAX Basics

VTSAX as a fund offers investors the opportunity to invest and benefit from the entire U.S. stock market, tracking the CRSP U.S. Total Market Index, giving investors maximum diversification, and relatively little risk. Because it holds small and mid-cap stocks as well as large-cap stocks, the fund will perform better than a large-cap fund when small or mid-cap stocks rally, although the smaller cap stocks increase the risk somewhat. Here are some facts about VTSAX:

- The expense ratio of VTSAX is .04%

- The dividend yield is 1.82%

- The minimum investment is $3,000.

Most of VTSAX is large-cap stocks, and the fund’s holdings are weighted by their float-adjusted market-cap, meaning that the value is determined by multiplying the stock’s equity by the number of shares that are available in the market. In essence, this means that the market determines the value, and the fund is weighted accordingly.

VTSAX is also offered as an ETF.

Comparing VFIAX and VTSAX

As you can see, both funds have an expense ratio of .04% and VFIAX has a slightly higher dividend yield. The Admiral shares of VFIAX, which are the only shares available to new investors, have had an annual return of 5.44% since 2000, which is just below the return of the S&P 500. The Admiral shares of VTSAX have returned 5.79% per year since 2000, virtually the same return as the stock market index.

Because of its large-cap holdings, VFIAX is less volatile than VTSAX, and therefore has a lower risk factor, but it’s return has been historically lower. VTSAX has more volatility due to it’s small and mid-cap holdings, which are inherently somewhat riskier, but a higher return. However, it is important to note that VTSAX is made up of mostly large-cap stocks, so the small and mid-cap risk, as well as potential returns, are not much higher than those of VFIAX.

On a risk adjusted basis the returns of both are virtually the same. VFIAX, however, has a higher dividend yield. Both have the same minimum investment of $3,000.

Which Fund is Right for You – VFIAX or VTSAX?

To determine which is right for you, you need to consider your investment goals. The goal of VTSAX is to allow you to capitalize on the potential returns of the entire stock market in the long run while also getting dividend income. You can potentially benefit from large-cap, mid-cap, and small-cap stocks, be fully diversified, and if history repeats, get a higher return. For example, if you invested $100,000 in VFIAX the last 25 years at the historical rate of return 5.44%, your money grew to $375,954.00. If you invested the same in VTSAX at a 5.79% return, your money grew to $408,428.00

If you are investing with a goal of earning income from the dividend yield, on the other hand, VFIAX may be a slighty better option than VTSAX.

Another consideration is that your portfolio can be fully invested in VTSAX because it is intrinsically fully diversified. VFIAX, on the other hand, should be only part of your portfolio if you want to be fully diversified and maximize your return potential. You would need to invest a portion of your portfolio in small and mid-cap stocks to achieve balance since VFIAX is made up only of large-caps.

Finally, your risk tolerance is a consideration, although the risk difference between VFIAX and VTSAX is small. If you want minimal volatility, VFIAX has historically proved slightly lower. As in all investing, it comes down to risk vs. return.