Schwab Intelligent Portfolios, provided by Charles Schwab, is a leading robo-advisor service in the US. Popular with investors, it’s designed to offer them a hassle-free, cost-effective portfolio tailored to their specific goals, risk comfort, and investment duration.

This service takes charge of constructing and managing a diverse exchange-traded funds (ETF) portfolio, allowing investors to start with a minimum of $5,000 without incurring fees apart from ETF operating expenses. Investors also have the flexibility to personalize their portfolios and benefit from tax-loss harvesting if they are eligible. Expert oversight from Schwab ensures automatic rebalancing and ongoing monitoring. Those seeking additional planning and investment advice can upgrade to Schwab Intelligent Portfolios Premium.

At a glance: Schwab Intelligent Portfolio pros and cons

Schwab Intelligent Portfolio Pros

- No management fees for basic accounts

- Diverse range of ETFs across asset classes

- Access to certified financial planners with a premium account

- Various account types: individual, joint, trust, custodial, and retirement

- Automatic rebalancing and tax-loss harvesting for accounts of $50,000 and above

Schwab Intelligent Portfolio cons

- High account minimums

- No manual customization of asset allocation

- High cash allocation requirements may expose investors to inflation risk

- No Tax-loss harvesting for accounts with balances less than $50,000

Account Services

Schwab Intelligent Portfolios offers a suite of services for users:

- Portfolio Management: It uses an advanced algorithm to create and manage ETF portfolios covering asset classes like US and international stocks, bonds, real estate, and commodities. The portfolio aligns with the user’s risk profile and goals and adjusts automatically with market changes.

- Tax-Loss Harvesting: For taxable accounts, this feature aims to minimize tax obligations by selling securities that have decreased in value and replacing them with similar ones. This method helps offset capital gains or income taxes while maintaining the portfolio’s intended balance and returns.

- Cash Management: Schwab Intelligent Portfolio allocates a part of the user’s portfolio into cash, stored in an FDIC-insured Schwab Bank account. This cash buffer offers stability during market fluctuations, ensuring liquidity for immediate needs, and earns monthly interest.

- Schwab Research Tools: Users gain access to a range of research resources—market insights, educational articles, webinars, podcasts, and videos—offered by Schwab. These tools aid in learning about investing, financial planning, and managing portfolios.

Types of Accounts Offered

Schwab Intelligent Portfolios provides two primary types of accounts:

- Taxable accounts: These are accounts subject to income tax on any earnings or capital gains. They encompass individual, joint, community property, custodial, and revocable living trust accounts.

- Tax-advantaged accounts: These offer tax benefits like tax-deferred or tax-free growth. Examples include traditional IRA, Roth IRA, rollover IRA, inherited IRA, SEP-IRA, and SIMPLE IRA accounts.

Fee Comparison

Schwab Intelligent Portfolios stands out for its low-fee structure compared to other robo-advisors. Regardless of the account type or balance, it doesn’t charge advisory fees, commissions, or account service fees. Instead, users only pay the operating expenses of the ETFs in their portfolio, typically ranging from 0.02% to 0.19% per year, depending on the portfolio’s makeup. These costs are on par with or lower than fees from competitors like Betterment, Wealthfront, or Vanguard Personal Advisor Services.

Yet, there’s a caveat to Schwab’s fee-free approach. Schwab Intelligent Portfolios Premium adds a one-time $300 planning fee and a monthly $30 subscription fee for access to the certified CFP financial planners and planning tools. These fees are separate from ETF expenses and can accumulate notably, particularly for smaller accounts. For instance, a $25,000 account would incur $660 in fees in the first year, equivalent to a 2.64% annual fee. This amount exceeds the management fee of Betterment Digital, which stands at 0.25% per year, and that of Wealthfront, also at 0.25%, by a considerable margin.

Portfolio Construction

Drawing from your responses regarding your goals, risk tolerance, and investment timeline, Schwab Intelligent Portfolios’ proprietary algorithm crafts a personalized portfolio from over 80 variations. This selection contains 51 ETFs meticulously chosen and overseen by Schwab experts, spanning over 20 expanded asset classes. These portfolios are designed around three distinct investment strategies: Global, U.S. Focused, and Income Focused, each offering diverse opportunities.

To cater to various risk appetites, Schwab Intelligent Portfolios offer six risk profiles, ranging from Conservative to Aggressive Growth, ensuring alignment with individual risk preferences for a tailored investment approach. It also considers the user’s tax situation, assigning a tax-sensitive or tax-efficient portfolio accordingly.

The portfolio construction process is overseen by Charles Schwab Investment Advisory, Inc. (CSIA), a registered investment advisor and Schwab subsidiary. CSIA handles ETF selection, determines asset allocation, and monitors portfolio performance. Regular updates and reviews of portfolios occur, informed by the latest market data and research.

Built on modern portfolio theory (MPT), this methodology aims to optimize expected returns given a certain risk level or minimize risk for a specified return. Strategic asset allocation sets long-term target allocations, while tactical asset allocation permits short-term adjustments based on market conditions.

Cash Management

Through its Sweep Program, Schwab Intelligent Portfolios allocates a segment of users’ portfolios to cash, housed in an FDIC-insured Schwab Bank deposit account. This cash allocation, determined by the user’s risk profile and tax situation, ranges from 6% to 30%. It cushions against market fluctuations, provides liquidity, and earns monthly interest.

The allocation percentage isn’t manually adjustable, being an integral part of the portfolio’s target allocation, automatically rebalanced by the algorithm. However, changes in risk profile or investment goals indirectly influence this allocation.

Critics argue that the cash allocation diminishes potential returns by reducing exposure to higher-returning assets like stocks and bonds, affecting long-term wealth accumulation, especially in low-interest environments. They also highlight inflation risks eroding purchasing power and the perceived conflict of interest benefiting Schwab through cash deposits and fees from portfolio ETFs, mainly Schwab-branded.

Still, the Schwab Intelligent Portfolio cash allocation offers stability and liquidity benefits, including reducing portfolio volatility, helping avoid emotional reactions, and providing easy access to funds without selling securities. Plus, the interest earned exceeds average savings account rates.

Automatic Rebalancing and Tax Loss Harvesting

Schwab Intelligent Portfolios streamlines portfolio optimization and tax efficiency through two automated features: automatic rebalancing and tax-loss harvesting.

Automatic rebalancing swiftly adjusts the portfolio when it strays from its intended allocation by around 5%. This process involves selling securities that have gained value and acquiring those that have decreased, reinstating the portfolio’s original risk-return balance. It serves to sustain diversification, curtail portfolio drift, and seize market gains for the user.

For taxable accounts, Schwab Intelligent Portfolios offers tax-loss harvesting upon user activation. This strategy involves selling underperforming securities and replacing them with similar ones to realize capital losses. These losses can then offset capital gains or income taxes, reducing the user’s tax burden while upholding the portfolio’s target allocation and anticipated returns.

The algorithm executes rebalancing and tax-loss harvesting seamlessly, requiring no direct intervention from the user. However, users can easily track and review transactions online or via the mobile app.

Stock Portfolio Makeup

Schwab Intelligent Portfolios invests in diverse stock ETFs across US and international markets, tailored to the user’s risk profile, constituting 20% to 95% of the total portfolio.

The stock portfolio comprises four key categories:

- US Large-cap: Tracks large US companies like the S&P 500, Dow Jones Industrial Average, or Nasdaq 100. Core to the portfolio, it offers exposure to established firms with stable earnings and strong balance sheets, typically accounting for 40% to 60%.

- US Small-cap: Follows small US companies such as the Russell 2000 or S&P SmallCap 600, adding diversification and growth potential. With higher returns but increased risk and volatility, this segment typically comprises 10% to 20%.

- International Developed: Tracks developed markets outside the US (e.g., Europe, Japan), reducing home bias and enhancing diversification with lower correlations to the US market. It usually represents 20% to 30% of the portfolio.

- International Emerging: Tracks emerging markets outside the US (e.g., China, India), providing diversification and growth prospects with higher risks and returns. Typically ranges from 5% to 15%.

Example Stock Investments

Schwab Intelligent Portfolios invests in ETFs like:

- Schwab Fundamental US Large Company Index ETF (FNDX): Tracks large US companies based on fundamental factors like sales, cash flow, and dividends to capture the value premium rather than focusing on market capitalization. This ETF maintains a lower technology and consumer discretionary sector weight and a higher weight in financials and industrials than the S&P 500.

- Schwab Fundamental US Small Company Index ETF (FNDA): Similar to FNDX but focusing on small US companies, aiming to capture the size premium. It also exhibits different sector weights, with lower exposure to health care and consumer discretionary sectors and higher weight in financials and industrials than Russell 2000.

- Schwab Fundamental International Large Company Index ETF (FNDF): Targets value premium in global markets by tracking large international companies through fundamental factors. It maintains different country weights, with a higher weight in the UK and lower exposure to Japan than the MSCI EAFE Index.

- Schwab Fundamental International Small Company Index ETF (FNDC): This investment fund is similar to FNDF but mainly concentrates on small international companies. Its goal is to take advantage of the size premium in international markets. It has lower exposure to Japan and higher weight in the UK when compared to the MSCI EAFE Small Cap Index.

- Schwab Fundamental Emerging Markets Large Company Index ETF (FNDE): This investment strategy focuses on large emerging market companies by using fundamental factors to target the value premium in volatile emerging markets. It maintains varying country weights, with less exposure to China and a higher weight in Russia than the MSCI Emerging Markets Index.

To optimize allocation and diversification, Schwab’s investment experts analyze market conditions, economic trends, valuation metrics, and historical performance. Regular reviews ensure alignment with the latest market data and research.

Fixed Income Portfolio Makeup

Schwab Intelligent Portfolios diversifies its fixed-income ETFs across US and international markets, ranging from 5% to 80% of the total portfolio, contingent on the user’s risk profile and portfolio type.

The fixed-income portfolio comprises five main categories:

- US Investment Grade: Tracks high-quality US bonds like US Treasury or Corporate bonds. Acting as the portfolio core, it offers exposure to secure and liquid US bonds with low returns, risks, and volatility, typically 40% to 60%.

- US High Yield: Follows low-quality US bonds such as US High Yield or Floating Rate bonds, adding diversification and income potential. These riskier yet profitable bonds usually represent 10% to 20% of the portfolio.

- International Developed: Tracks developed markets outside the US (e.g., Europe, Japan), reducing home bias and enhancing diversification with lower correlations to the US market. This segment usually represents 10% to 20% of the portfolio.

- International Emerging: Tracks emerging markets outside the US (e.g., China, India), providing diversification and growth potential with higher correlations, risks, and returns. Typically ranges from 5% to 15%.

- Inflation-Protected: Follows inflation-linked bonds like US TIPS or Global Inflation-Linked bonds, shielding the portfolio from inflation risk. These bonds, adjusting for inflation in principal and interest payments, typically account for 5% to 10% of the portfolio.

Schwab’s investment experts advocate the fundamental approach, believing it can yield better risk-adjusted returns, especially in volatile or inefficient markets. These unconventional stock allocations undergo regular reviews and updates, aligning with the latest market data and research to ensure relevance and effectiveness.

Portfolio Management

Schwab Intelligent Portfolios combines automated processes and human oversight to manage user portfolios. The process involves these key steps:

- Portfolio Creation: Through a series of inquiries about investment goals, risk tolerance, and preferences, Schwab’s algorithm selects from predefined portfolios across up to 20 asset classes. It tailors the portfolio to the user’s needs, accounting for tax considerations by assigning a tax-sensitive or tax-efficient portfolio.

- Portfolio Monitoring: The system performs daily checks using current market data, evaluating portfolio performance, risk, and deviation from target allocation. It triggers alerts or actions as needed to maintain alignment with the user’s objectives.

- Portfolio Rebalancing: When the portfolio deviates more than 2% from its target allocation, Schwab Intelligent Portfolios rebalances by selling overperforming securities and acquiring underperforming ones to restore the original risk-return profile and capture market gains.

- Portfolio Adjustment: The portfolio undergoes periodic adjustments based on the latest market data and research. The algorithm reviews and updates the portfolio’s target allocation, ETF selection, weightings, and cash allocation while considering the user’s risk profile and prevailing interest rates. This process ensures that the portfolio is optimized and remains suitable over time.

- Portfolio Optimization for Tax Efficiency: Tax-loss harvesting is used in taxable accounts to offset capital gains or income taxes by selling underperforming securities and replacing them with similar ones. This approach helps to minimize tax liability while maintaining the portfolio’s target allocation and expected return.

Financial Planning

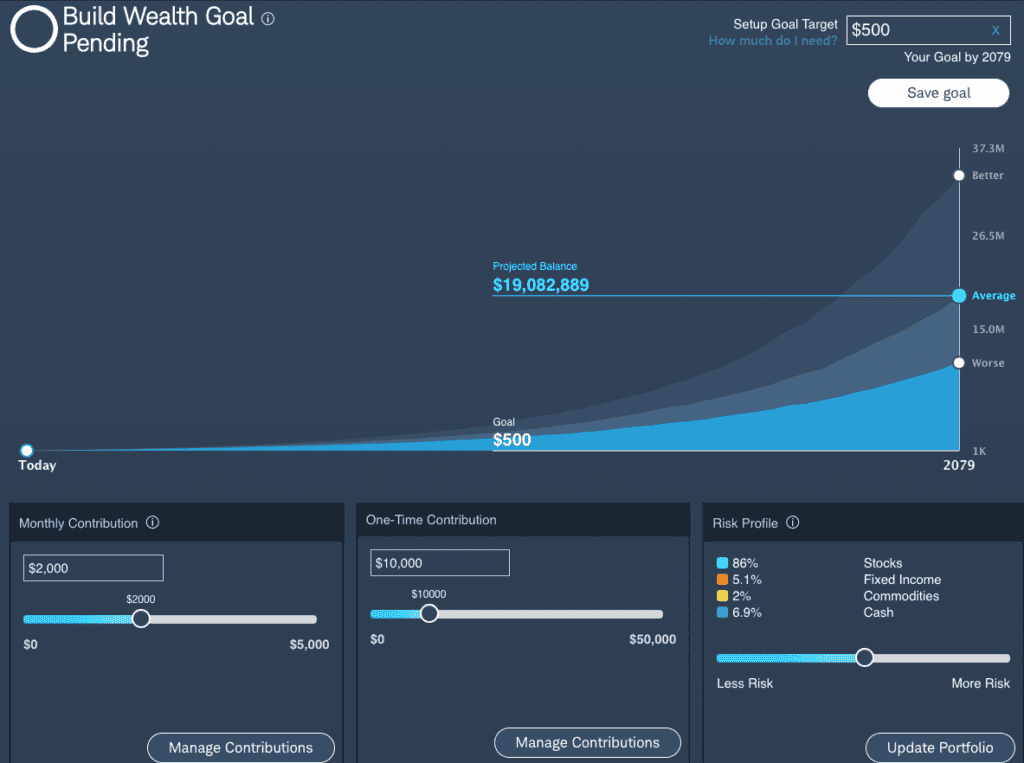

Schwab has a limited wealth building goal tool, that was also a bit finicky when we were trying to play with it. Not sure where the projected balance of $19,082,889 was coming from — I certainly do not have that much in my account! (In fact it was 0 at this stage). Provided it works, the tool estimates what monthly contribution and one-time contribution you need to reach your goal.

Schwab Research Tools

Schwab Intelligent Portfolios offers users a suite of research tools and resources via Schwab, providing insights into investing, financial planning, and portfolio management. Some key resources include:

- Schwab Market Update: A daily newsletter delivering the latest market news, analysis, and commentary on US and international markets, spanning various asset classes, sectors, and themes. It employs charts, graphs, and tables to illustrate market trends and movements.

- Schwab Investing Insights: A compilation of articles, podcasts, and videos offering in-depth, actionable insights on investing topics. This content, curated by Schwab’s investment experts, analysts, and strategists, covers portfolio strategies, asset allocation, risk management, market outlooks, and more, updated regularly.

- Schwab MoneyWise: A comprehensive financial education program equipping users with tools and resources for achieving financial goals. It covers budgeting, saving, investing, retirement planning, college savings, estate planning, and more through articles, calculators, worksheets, quizzes, and workshops, facilitating learning and practical application of financial concepts.

- Schwab Live: Live webinars and events offering user interaction with Schwab’s investment professionals and experts. Users can ask about investing, financial planning, and portfolio management topics. The events occur regularly and are archived for convenient access.

These resources collectively empower users to stay informed about market trends, gain valuable insights into investment strategies, enhance financial knowledge, and actively engage with Schwab’s experts for guidance and clarification.

How does Schwab Intelligent Portfolio compare?

Schwab Intelligent Portfolio vs. Betterment

Betterment is a robo-advisor providing automated, low-fee portfolios for investors of any size. It offers features like goal planning, tax-loss harvesting, and access to certified financial planners. Portfolios consist of ETFs covering various assets and risks.

Compared to Schwab Intelligent Portfolios, Betterment charges a 0.25% annual fee but has no minimum account balance requirement. Schwab is free but requires a $5,000 minimum.

Schwab Intelligent Portfolio vs. Wealthfront

Wealthfront offers diverse products for saving, investing, and growing your money. You can earn a 5.00% APY on your cash, invest in low-risk bond ETFs, or pick different risk levels for your goals. Additionally, you can explore and buy individual stocks in a taxable account with no commissions.

Wealthfront shines with a digital financial planning tool called Path, helping users plan for goals like retirement, home buying, and college savings. In comparison, Schwab Intelligent Portfolios has a wealth goal tracker that lacks some of the scenario analysis and recommendations of Wealthfront’s Path tool.

Schwab Intelligent Portfolio vs. Fidelity Go

Fidelity Go, from Fidelity Investments, is a robo-advisor crafting personalized portfolios for investors. You can start with no minimum investment and pay no advisory fees for balances under $25,000. With balances of $25,000 or more, you get access to financial coaching. Your money is invested in Fidelity Flex mutual funds, which have zero expense ratios and no trading fees.

Unlike Schwab Intelligent Portfolio, Fidelity Go exclusively uses Fidelity Flex mutual funds instead of various ETFs. While this means lower fund costs, it also results in less diversification and transparency than Schwab Intelligent Portfolio.

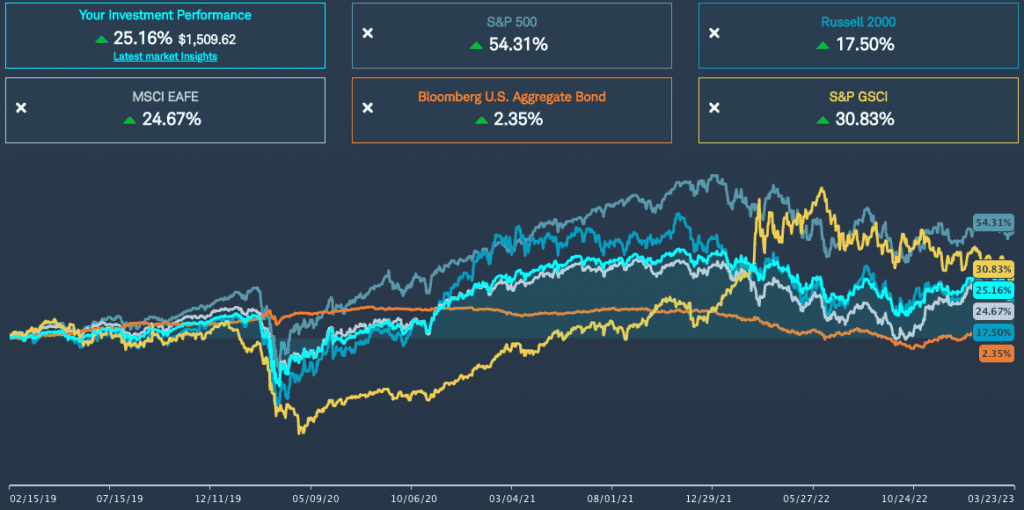

Why I closed my Schwab Intelligent Portfolios Account

No fees seems like an attractive entry point, but the reality is, Schwab is charging fees in other ways — either by taking a spread on the interest they pay on your higher than normal allocation to cash, or through embedded ETF expense ratios. It’s impossible for the service to be completely free. Because I don’t like that lack of transparency, I decided to close my Schwab Intelligent Portfolios Account. It was also underperforming the S&P heavily over a 4 year period.

Schwab Intelligent Portfolios Review: Innovation-Driven Investing

Schwab Intelligent Portfolios is an automated and cost-effective investment service that provides a diversified portfolio based on individual goals, risk tolerance, and time horizon. It offers various features such as portfolio management, tax efficiency, cash management, and research tools to cater to different investor needs. Two types of accounts are available: Schwab Intelligent Portfolios and Schwab Intelligent Portfolios Premium, which mainly differ in the level of human guidance provided.

Schwab Intelligent Portfolios stands out with its unique fee structure, which does not charge advisory fees. It also offers tax efficiency through tax-loss harvesting and ensures diversification by investing across 20 asset classes. However, drawbacks to this service include its cash allocation strategy that allocates higher percentages to cash. Essentially, they are charging implied fees by giving you a higher cash allocation, which is not a transparent pricing policy.

Schwab Intelligent Portfolios suits investors who want a diversified portfolio at a low cost who are comfortable with conservative cash allocations. The Premium option offers unique human financial advisor access. However, it may not be ideal for investors seeking higher returns or lower cash allocation found in other robo-advisors.