Source: Quicken

Simplifi by Quicken is a paid personal finance app that gives you a birds’-eye view of your money from income to investment.

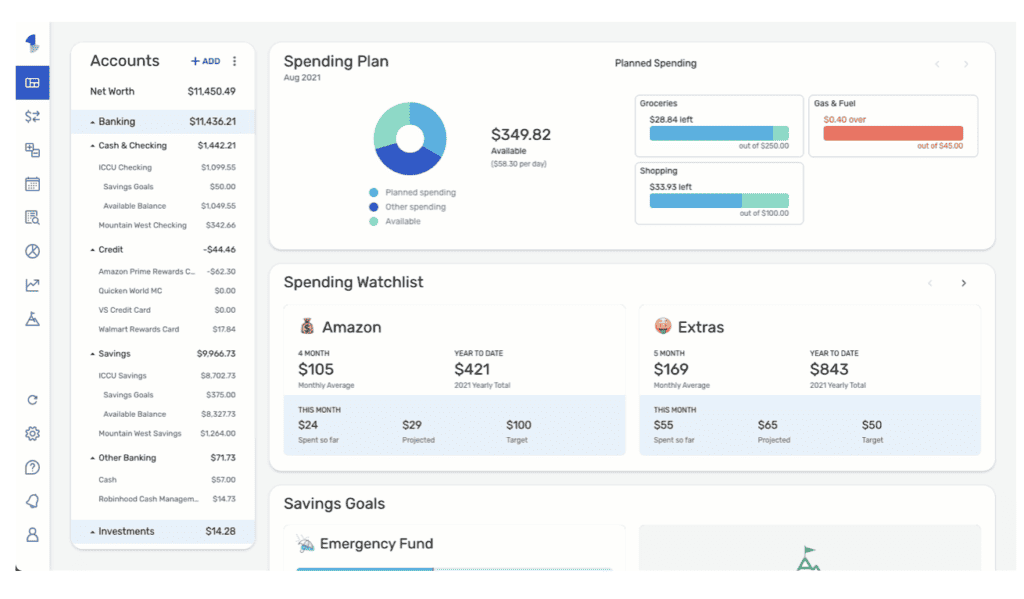

The tool connects to your financial accounts and uses the information to help you budget, save, and spend more responsibly. Plus, it analyzes your data and presents insights via easy-to-read visuals and monthly spending reports.

The end result: a budgeting app that tunes you into your finances like never before. (full disclosure, the owner of this site writes for Quicken and uses Simplifi.

At a glance: Quicken Simplifi pros and cons

Pros

- Breaks down information simply and visually

- Flexible budgeting and transaction management tools

- Get reminders on upcoming payments and savings goals

- Extensive financial reporting

- Ad-free experience

Cons

- No free plan

- No credit scoring tools

- Doesn’t link to other Quicken tools

- Only available in the U.S.

- Some tools still under development

Source: Quicken

What is Simplifi by Quicken?

Simplifi is a deceptively simple financial tracking and budgeting app that aims to “Simplifi” your finances. It works as a financial aggregator, linking to your bank account, credit cards, investment accounts, etc. (Currently, Quicken connects with over 14,000 institutions in the U.S.)

Then, Simplifi gathers all your data and spits out breakdowns and insights onto a single, simple dashboard so you can visualize your finances. Simplifi inputs this information into its various tools to help you:

- Set savings and spending goals

- Budget flexibly on your own terms

- Categorize, split, and ignore transactions

- Stay ahead of upcoming bills

- Track your investments

On top of all that, Simplifi generates monthly insights and reports so you can get an even more in-depth financial picture. And if you ever need assistance, you can consult Simplifi’s how-to files or contact customer service from 5a-5p, 7 days a week.

How does Simplifi by Quicken work?

Simplifi provides many features you expect of budgeting apps, including expense tracking and goal setting.

However, it largely steers away from the word “budget,” removing the pressure to keep a strict hold on your finances. Instead, manage your discretionary income with “Spending Plans” and set category-specific spending caps with “Watchlists.”

Plus, use Simplifi’s tools to automatically or manually categorize and track expenses and monitor bills and subscriptions. The app will even notify you of unusual activity and upcoming due dates so you’re not caught by surprise.

How much does Quicken Simplifi cost?

At the time of writing, Simplifi cost $2 per month billed annually, down from $3.99 per month. (The app is known for running frequent promotions and discounts.) If you’re unsatisfied with your purchase, Quicken has a 30-day money-back guarantee.

Source: Quicken

Simplifi’s key features

Quicken’s personal finance app has a lot to recommend it, but we’ll just touch on the key features here.

Track and categorize income and transactions

After linking your accounts, Simplifi continuously imports and analyzes your data. The first step in the process is dividing your transactions into categories and subcategories using Simplifi’s presets or creating your own. (For instance, your “Entertainment” category could include subcategories like “Restaurants” and “Concert tickets.”)

Beyond basic financial tracking, you can also:

- Flag transactions

- Add notes, tags, and attachments

- Split transactions among multiple categories and tags

- Exclude transactions

- Track expected refunds

This is just the first step in the Simplifi journey. All your categorized data then flows into your Spending Plans and Watchlists, informing the bulk of your financial strategy.

Savings Goals

Simplifi makes it easy to set customized Savings Goals in your dashboard. Target your ideal retirement savings, stash for your dream vacation, or prepare for next year’s holiday presents. Whatever your personal finance goals, Quicken will keep you on track by monitoring your progress and sending regular updates and reminders.

Source: Quicken

Spending Plans

Simplifi’s Spending Plan serves as a simple, incredibly flexible budget to fit any life. Your individualized plan divides your monthly budget into four parts:

- Discretionary income: What’s left after subtracting recurring bills and savings from your income

- Planned spending: What you plan to spend on fluctuating bills (like groceries and gas)

- Other spending: An up-to-minute tally of your other monthly expenditures

- Available spending: What’s left after deducting Planned and Other Spending from your discretionary income

You can even project your Spending Plan up to 12 months ahead to get an idea of your future finances! This combination of flexible forecasting and considering your actual finances (not your “ideal” finances) means that Spending Plans will fit almost any budgeting method.

Spending Watchlists

The data accrued so far then flows into your Watchlists, which is where the app holds you accountable without laying on the guilt trip.

Each Watchlist reflects your ideal spending target for a given budget category, payee, or tag. Set your maximum monthly spending limit per category, and Simplifi will track your categorized transactions and send alerts when you near your limit.

For instance, if you budget $150 per month for Entertainment, you can spend it at the movies, ladies’ night, or bowling with friends. You don’t have to choose your activities ahead of time – instead, Watchlists focus on overall monthly limits.

Naturally, both your Spending Plan and Watchlists appear prominently on your dashboard, showing your target amounts, current balances, future projections, and monthly and annual averages.

Investment tracking

In August 2023, Simplifi finally expanded its investment dashboard to provide more comprehensive spending tracking. Its up-to-date investment tracking abilities let you:

- View your real-time balance

- Monitor your long-term performance

- Track your crypto holdings

- Monitor individual investment transactions

Plus, your personalized news feed and insights will ensure you can stay “in the know” as you grow.

Comprehensive reporting to keep you on track

The information imported from your accounts and generated by your Plans and Watchlists flows into your centralized dashboard. This doesn’t just overlook your finances: it tracks your net income, spending, and savings; analyzes your data; and spits out personalized insights and monthly charts.

Then, Simplifi presents the information using clear, colorful charts so you can readily identify your weak spots and celebrate your progress. Take further control by customizing your dashboard or monitoring your progress by category, tags, or payees.

Family Sharing

Every Simplifi plan comes with Family Sharing so you can keep your household, accountants, and tax pros in the know. Share up to six logins so you can:

- Do your finances as a household

- Set and achieve family savings goals

- Share your budget and finances with your financial professionals

Where Simplifi by Quicken falls short

No financial app is 100% perfect, and Simplifi is no exception. Here’s where the app could do better.

No free plan

As a paid tool, Simplifi eats into your budget. However, the amount is relatively modest – usually less than $50 a year. Not to mention, you won’t have to deal with annoying ads or partner recommendations.

Limited credit score tools

Unlike many of its peers, Simplifi doesn’t offer any credit score monitoring tools. You’ll need a separate app to access and track your credit score data.

No direct control over outside accounts

As an aggregator, Simplifi doesn’t actually interact with your financial accounts – it just pulls the data. While you can monitor and track your transactions, goals, and progress, you can’t use Simplifi to move funds or pay bills. Most budgeting tools don’t allow you to do this anyway.

Who should use Simplifi by Quicken?

Simplifi is a solid option if you want to visually organize and monitor your finances. Its handy tools will help you budget, set goals, identify potential holes in your strategy, and track your progress.

But Simplifi’s not for everyone. As a new app, it lacks more advanced features like in-depth investment tools and direct control over linked accounts. Additionally, users with fluctuating monthly incomes may find that its prediction tools over- or under-estimate their monthly spending power.

How to open a Quicken Simplifi account

Source: Quicken

Opening a Simplifi account is incredibly easy! Just visit Quicken’s Simplifi page and hit “Get Started.” To sign up, you’ll need your email address, phone number, and password, plus your billing details. After activating your new account, you’re all set to start managing your finances!

Looking at the competition

Quicken Simplifi vs. YNAB

You Need A Budget is a paid budgeting app that focuses on taking financial control through zero-based budgeting. By assigning every dollar a job, YNAB’s strategy can help you pay off debt, buff your savings, and strap down footloose spending habits. However, YNAB is less interested in factors like investing and mile-high oversight than Simplifi.

Quicken Simplifi vs. Rocket Money

Rocket Money is a money management app that tracks your spending, helps you build a budget, and even negotiates your bills. Where Simplifi focuses more on visualizations, Rocket Money focuses more on direct spending management. While the base app is free, you’ll pay for specialized services.

Quicken Simplifi vs. Empower

Empower offers more specialized functionality than Simplifi; its focus lies more with investing and long-term wealth building. Empower’s free tier operates as a financial aggregator with basic investing tools built-in. The premium version, available to those with portfolios worth $100,000+, boasts fancier tools, strategies, and even coaching.

What we really think of Simplifi by Quicken

Simplifi is an impressive budgeting app for those who prefer to visualize their finances from above. It offers a clean user experience, an intuitive dashboard, and even Family Sharing features to round out its wheelhouse. Impressively, the app even manages to straddle the balance between micromanagement and hands-off budgeting. That said, not everyone wants to pay for features available for free elsewhere.

FAQs

Is Simplifi safe to use?

Yes! Quicken, the company behind Simplifi, has operated in the software-personal finance space for three decades. It employs top-notch security protocols, including secure data transmission and multi-factor authentication.

Are paid budgeting apps worth the cost?

Whether a paid budgeting app makes sense depends on your situation, wants, and needs. Paid apps usually offer more features, smoother interfaces, and an ad-free experience. That said, many free personal finance apps cover the basics just fine.

What does Simplifi by Quicken do?

Simplifi is a budgeting and personal finance app that aggregates your accounts and monitors your financial health. You can build a budget, set and track savings goals, identify holes in your strategy, and more.

Can I use Simplifi for budgeting?

Simplifi boasts some pretty handy (and unique) budgeting tools that marry flexibility and comprehensive visualization. In other words: Yes, you can use Simplifi for budgeting.