This site aims to help you build and preserve your wealth. And preserving your wealth is a defense against one of the two oldest truths, death and taxes.

Obviously, wealth is no defense against death. But wealth preservation is a defense against human society’s oldest truth, which is that all governments will tax the people, both visibly and invisibly, in order to fund their own ends.

The fundamental truth I’m referring to on this site is inflation. It’s an invisible tax. Inflation is a tax because it makes your money worth less every passing moment, and it’s inevitable in human societies. It’s happening right now, in your country and in your currency, guaranteed.

Why is it inevitable? Because all human governments have one aim, which is to stay in power, and in order to fulfill this one primary aim, they will do anything. They will spend, borrow from the future, print money – and in so doing, make their currencies worthless or near worthless. Except in some cases, this is usually long-term process, and because it happens over decades, and centuries, it’s often ignored.

And whether or not you think the government has nefarious aims (I do not), inflation is real, it’s a truth in all societies, and it’s here with us now.

Current Inflation

So, inflation. Reading this a decade after the GFC, you might have been led to believe that it’s disappeared. After all, according to BLS estimates, inflation has been between 0% and 3% in every year since 2008, with a low of 0.7% in 2015.

Regardless of your political views, every administration will try to convince you of this untruth.

So, the BLS states that since the GFC in 2008, the last decade has seen almost no inflation.

Oh really.

Where do we start here? Maybe the best framework is to start with the categories we spend the most money on, as Americans.

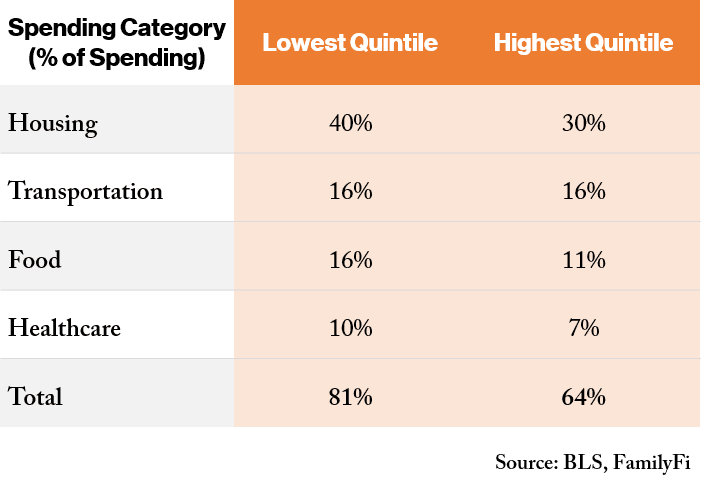

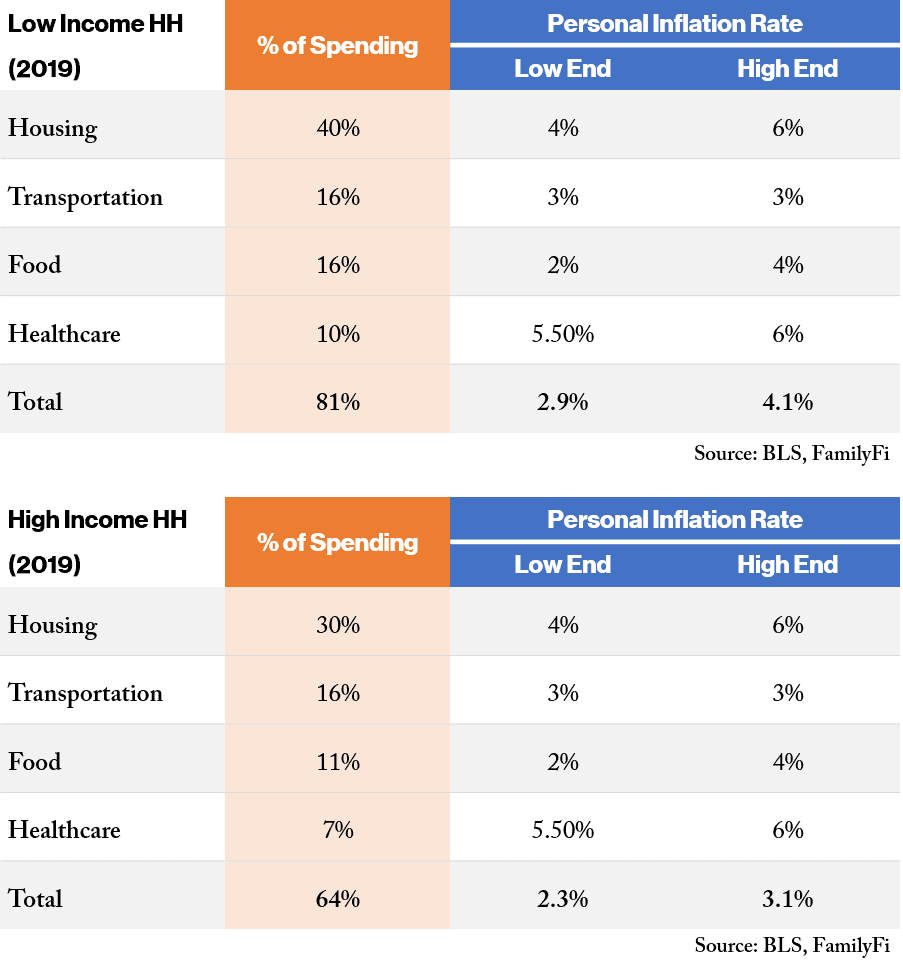

As of last June (2019), the biggest categories of spending are housing, transportation, food, and healthcare. For all categories of income earners, these 4 categories alone account for an average 70% of spending. For lower income earners, however, it comprises a full 80%. Even higher income groups spend more than 60% of expenditures on these categories.

That fact should be of no surprise to anyone. Of course these categories are what we spend our money on.

Now, before we get into an analysis of these four components and their actual inflation rates, let’s do a thought experiment. This whole discussion would be irrelevant if wages had kept up with inflation. After all, if wages are growing at 3% and the prices of everything else are growing at 1-3%, then what is there to worry about?

But the problem is that this is decidedly not the case. Median household incomes grew at a rate of 0.5%-1% per year over the last ten years.

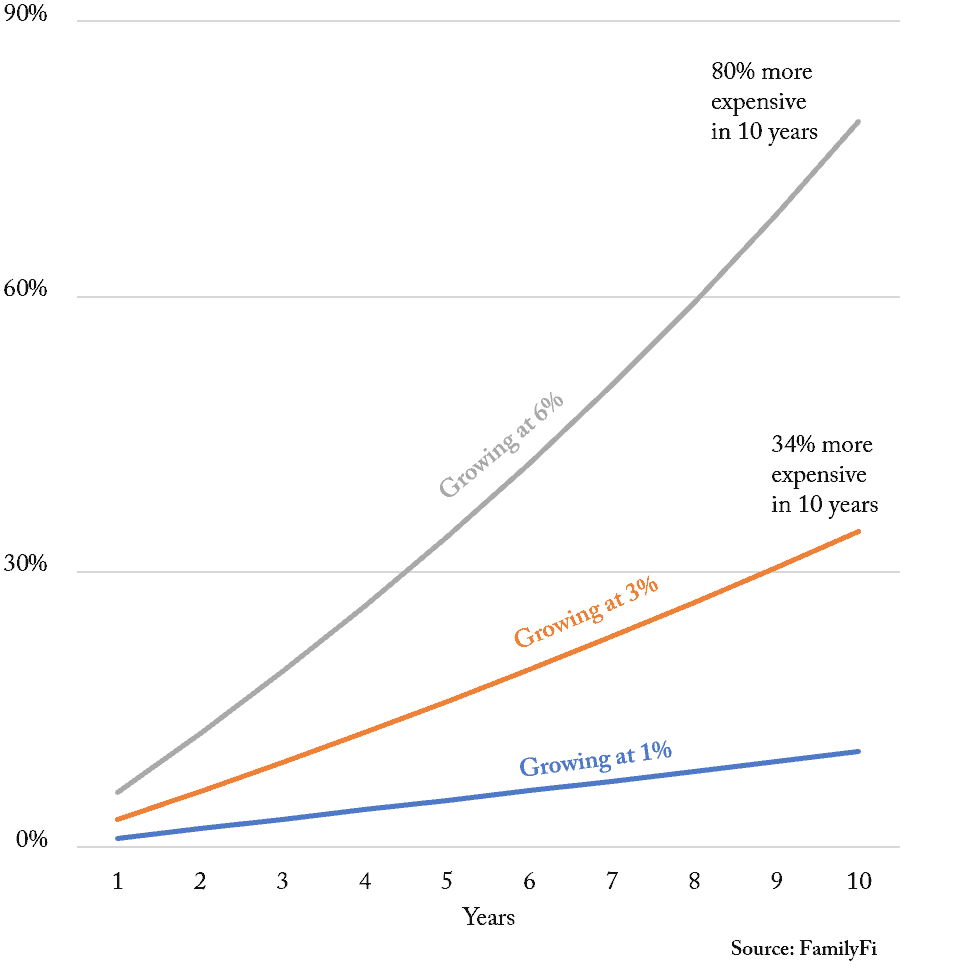

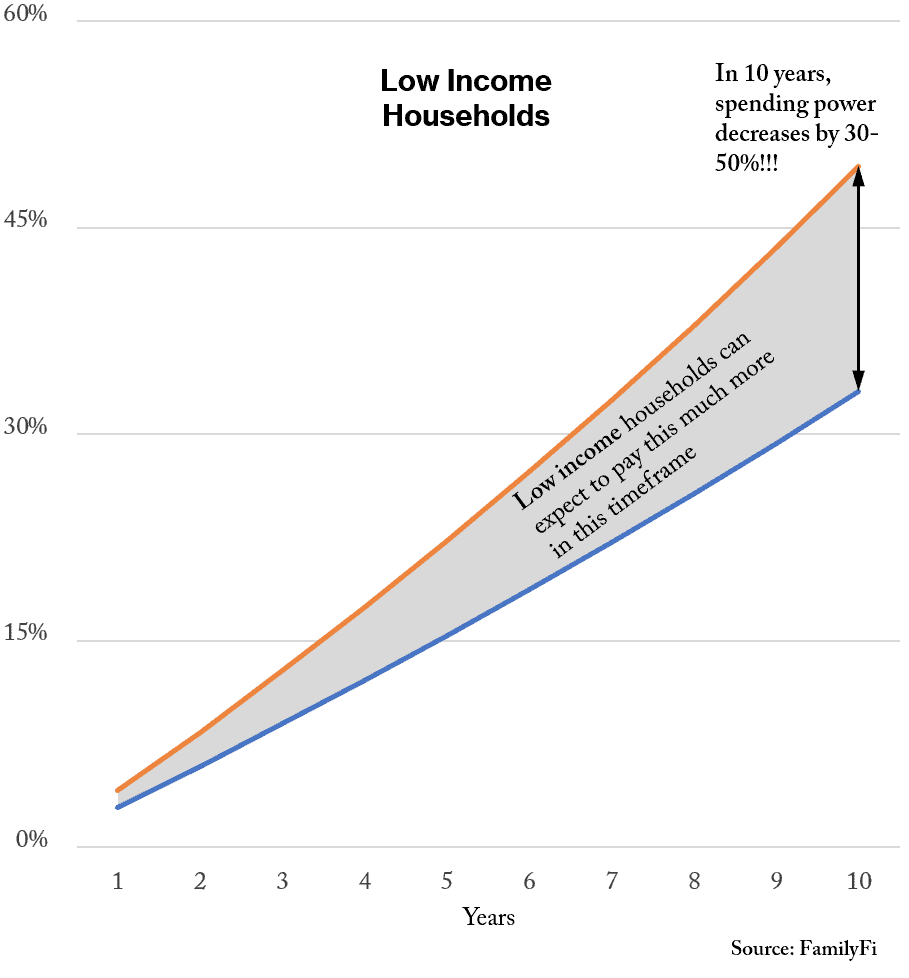

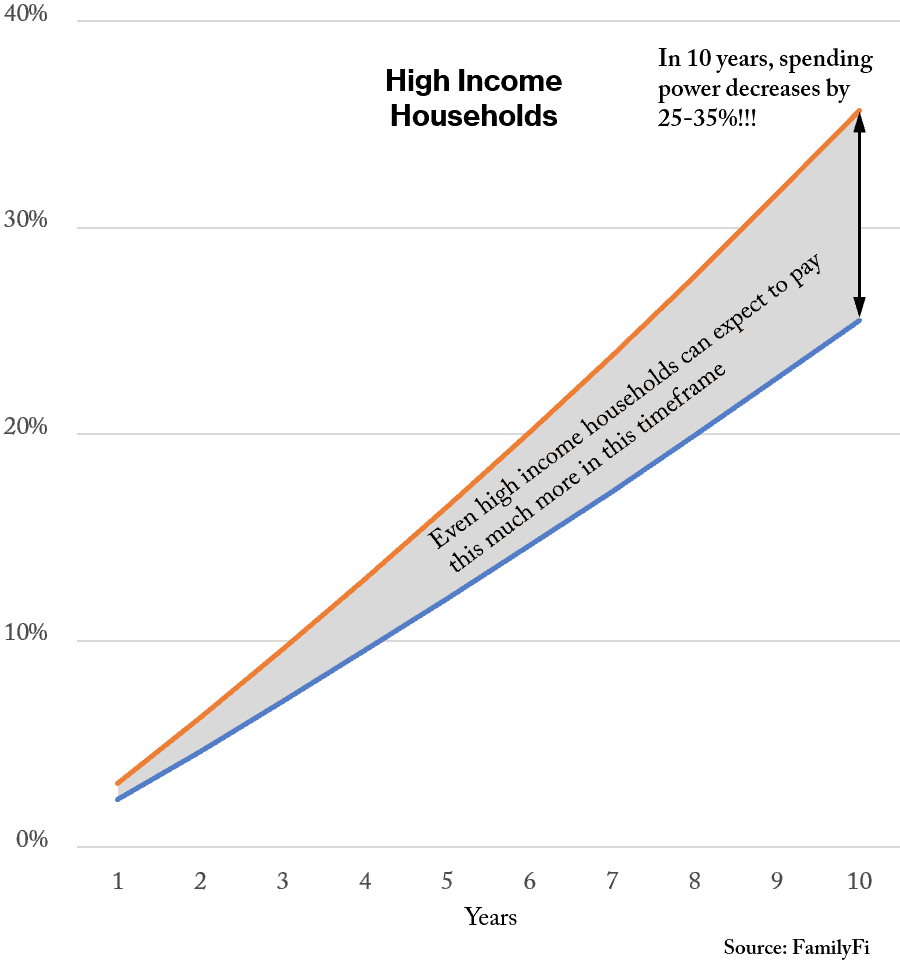

So you can see the first problem. If costs are going up by up to 3% (according to official numbers), and wages are growing at close to 0%, that means costs have actually risen by more than 30% across the board, over the last ten years (3% per year). This means your dollar has shrunk by 34% in purchasing power.

That would be a problem without the real rates of inflation for costs that people actually care about. But the rates of inflation for housing, transportation, food, and healthcare have been much higher than wages, and much higher than the “official inflation rate” of between 0 and 3% as well.

Inflation by Category

1. Let’s look at housing first.

If you’ve lived in a major US city, then over the last ten years you’ve witnessed housing prices – and rents following suit – grow at 5-6% annually. This is nearly 3x the rate of “inflation”.

5-6% doesn’t sound like a lot on an annual basis, but 5-6% a year means that housing prices double in ten years, which they clearly have and more. Back in 2018, CNBC reported that housing prices averaged 5% rates of growth per year. Just this year, Los Angeles saw a 7% increase in January. In San Francisco, this study reveals that rents have been increasing at 6.6% a year since 1956.

Even with the impact of the GFC factored in, the lowest priced homes in America (across 285 metropolitan areas, which would incorporate most of the population) increased by a rate of over 4% a year since 2000. This is double the rate of our supposed “inflation”.

2. Transportation is the next largest category.

But here too, we see the same trend. Both new and used car prices between 2009 and 2019 increased at over 3% annually. Again, the reason this doesn’t sound more alarm bells is that 3 seems like a low number. Close enough to 0, right?

But think about it in terms of growth rates. Something growing at a rate of 2% will be more than 22% higher in ten years. Something growing at a rate of 3% will be 34% higher in ten years.

And the more important thing here is that as the article points out, these categories of expenses are increasing despite incomes staying flat.

3. The same with our next category, food. For lack of a better and more reliable number, we’ll take the BLS’ word for it.

According to the agency, food costs have been increasing at between 1 and 4% every year while household incomes have been increasing at half a percent. This means that food now is at least 15-20% more expensive than it was 10 years ago.

Not only that, but the suggested tips at restaurants have increased to 18-20% from 15% just a decade ago, while our food quality has been steadily getting worse. Inflation isn’t just an increase in price. Prices that remain the same with eroded quality is, essentially, the definition of inflation.

4. Now onto healthcare.

Out-of-pocket healthcare expenses have been increasing at a rate of 5-6% over the past 10 years (a cumulative 71% increase), and is basically expected to keep increasing at that same rate over the next decade. Note that this rate of inflation (~6%) has been happening for the last 20 years for hospital-based services, which are the largest part of healthcare expenditures.

In summary, here’s where we stand:

- US household incomes have increased at 0.5% annually over the last ten years.

- Housing prices have been increasing at 4-6%. Again, make a note that 4% might not sound like a lot, but that means 50% higher costs in 10 years.

- Car prices, both new and used, have been increasing at 3% annually over the last 10 years. That means cars are 30% more expensive now than 10 years ago.

- Food prices have been increasing at 1 and 4%. At 2%, it means food is 20% more expensive now than 10 years ago.

- Healthcare costs have been going up at between 5-6% over the past 10 years. This means healthcare costs are between 60-70% more expensive than 10 years ago.

Let’s do some illustrative calculations here.

This means that our dollars buy 50-80% less housing, 30% less transportation, 15-20% less food, and 60% less healthcare. On a blended basis, our incomes (the money we have to spend) can purchase approximately ~30-40% less than ten years ago.

And don’t just take our word for it; here’s a similar analysis:

So there’s been no inflation? I.e., there’s been no decrease in the purchasing power of our money? Really?

That is the great lie of every government, and one of the great truths of all human societies.

Summary and Context

There needs to be a prescription against this persistent devaluation. How can we preserve our wealth and purchasing power in the face of this inexorable truth?

Over the past decade since the GFC, there’s been a lot of interest in financial independence (FI) and early retirement. A lot of this advice has been of the minimalization type; i.e., decreasing expenses.

But as you can see, just decreasing expenses alone won’t help if the money you do have is continuously decreasing in purchasing power as well.

This truth is something that should be taught in high school and college courses, but isn’t. In fact, I can’t remember a single history course that actually talked about inflation and poor economics being a root cause of discontent, when it clearly is.

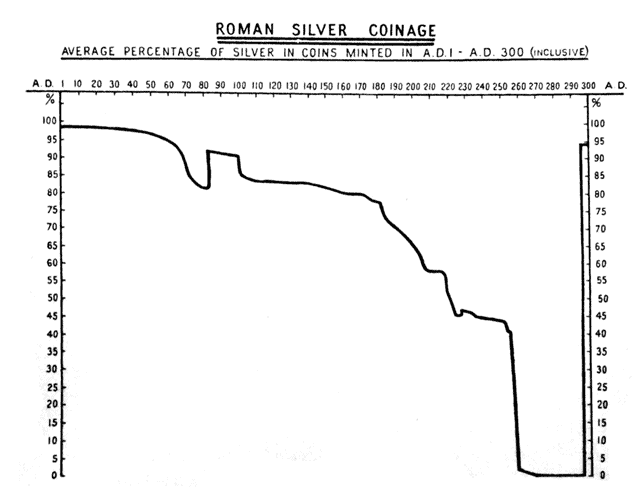

The history of inflation is long. The currency of ancient Rome lost more than 90% of its value over a 200 year period, from emperor Nero to Diocletian. During this period, “the price of wheat had then gone up about 200 times in a century and a half…Silver thus rose less than half as much as wheat, but twice as much as gold”. That equates to a price inflation of approximately 3.8-4% for wheat (do these inflation rates look familiar?). Again, ~4% a year means that it’s 50% more expensive in 10 years.

Ordinary soldiers during this time were also subject to a gradual decrease in real wages; soldiers in the second century “had received gross pay of 300 denarri, that is 12 aurei or 4/15 lb. gold”, but by the fourth and fifth century, their wages in gold had dropped to “1/6 lb. gold, that is, about two-thirds in gold value of the pay of the second-century soldier.”

Now, could it be true that during this time, a similar amount of gold went a lot further? I.e., a rise in living standards? This, of course, is the argument of all governments that are spending their way into devaluation. It can, but considering that this period is coinciding with an overall decline in the influence of the Roman empire, and about 50-100 years out from its collapse, that’s not much of a consolation to the citizens.

Ray Dalio, founder of Bridgewater Associates, one of the world’s largest hedge funds, has a more modern take in this essay, and bluntly titles one of the sections All Currencies Have Been Devalued or Died. He writes that of “the roughly 750 currencies that have existed since 1700, only about 20% remain, and of those that remain all have been devalued.”

In real terms, the value of all major currencies against gold have decreased by 80-90% since 2000.

Dalio’s piece is especially important because he points out the cause of these currency devaluations in the modern era as being debt. Currencies are being devalued because governments are printing the currencies, and they’re printing more of the currency in order to pay for higher debt levels, and they have higher debt levels because they’re continuously spending. Especially in the post-GFC era.

And so it goes.

So it has gone throughout the millennia of man’s development. For at least the four thousand years of recorded history, man has known inflation. Babylon and Ancient China are known to have had inflations. The Athenian lawgiver Solon introduced devaluation of the drachma. The Roman Empire was plagued by inflation and, more rarely, deflation. Henry the Eighth of England was a proficient inflationist, as were the kings of France. The entire world underwent a severe inflation in the sixteenth and seventeenth centuries as a result of the Spanish discoveries of huge quantities of gold in the New World. “Continentals” in the American Revolution and the assignats in the French Revolution were precursors of the wild paper inflations of the twentieth century. Steadily rising prices have been the general rule and not the exception throughout man’s history.

The twentieth century brought the institution of inflation to its ultimate perfection. When economic systems are so highly organized as they became in the twentieth century, so that people are completely dependent on money trading for the necessaries of life, there is no place to take shelter from inflation. Inflations in the twentieth century became like inflations in no other century. The two principal inflations that occurred in advanced industrial nations in the twentieth century will probably prove to have done more to influence the course of history itself than any other inflation.

That is from Jens Parsson’s Dying of Money, and the two inflationary episodes covered in the text are the German hyperinflation between the two world wars, and the American inflation of the late 1960s and 1970s. While the history books (here in the US) are rife with photos of those poor Germans burning stacks of reichsmarks as kindling, I bet you didn’t really learn about that second one in school, did you?

The point is, inflation is a fact of civilization. It is one of the great truths, and understanding that it exists as a sort of ‘societal tax’ that will steadily eat away at your money over time is one of the foundations of financial literacy.

Our prescription here at FamilyFi is, we hope, a combination of common sense, balanced investing principles, and the long view. Just decreasing expenses is not a complete solution. Neither is blindly investing in gold and cryptocurrencies while decrying government conspiracies. The stock market and ETFs are not a panacea. It’s our view that a balanced approach is best.

Don’t just take our word for it. Again, from Dalio:

Most people don’t pay enough attention to their currency risks. Most worry about whether their assets are going up or down in value; they rarely worry about whether their currency is going up or down. Think about it. Right now how worried are you about your currency declining relative to how worried you are about how your stocks or your other assets are doing? If you are like most people, you are not nearly as aware of your currency risk and you need to be.