If affordability sits at the top of your list at tax time, FreeTaxUSA may be the right fit. FreeTaxUSA has an easy-to-use platform that guides you through preparing your taxes. This online tax filing software is a good option for filing a simple return or if you feel comfortable doing your taxes on your own. Best of all, FreeTaxUSA charges nothing to file your federal tax return.

Who should use FreeTaxUSA

With FreeTaxUSA, you get quality tax filing software without a hefty price. Whether you have a simple or complicated return, the program is versatile enough to handle most tax situations. The tradeoff of its budget-friendly price is you won’t find the same robust support with FreeTaxUSA as you might with competing tax software packages. If you are comfortable filing on your own or don’t mind waiting for customer support, FreeTaxUSA may be the right choice.

While FreeTaxUSA can handle most complicated tax issues, the program does not support taxpayers who live outside the United States, nonresident alien returns or foreign employment income.

How does FreeTaxUSA work

FreeTaxUSA offers a simple platform that fits the needs of just about any tax filer. You start by entering your personal information. The platform then guides you through the tax filing process, beginning with your income and then deductions. From there, you’ll answer questions to determine if you qualify for other deductions and credits.

FreeTaxUSA automatically calculates as you enter tax information and displays your estimated tax refund or bill on the screen. Before you file, the software checks your entries and searches for possible deductions or credits you may be eligible for. Once done, you can check over your return before sending it off.

You can e-file your return through FreeTaxUSA. Or print it out and mail it.

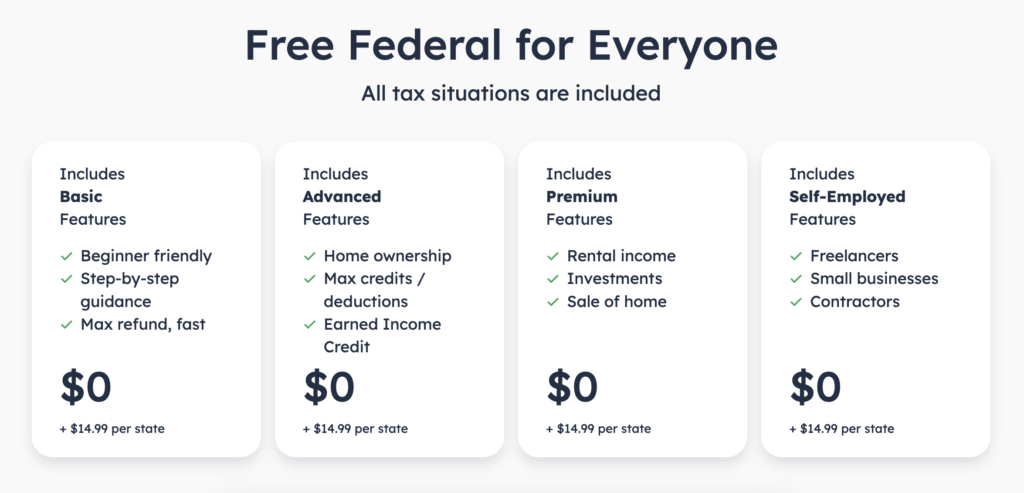

How much does FreeTaxUSA charge?

It doesn’t matter how basic or complicated your federal tax return may be; you never pay to e-file your federal return with FreeTaxUSA. Whether you are self-employed or have rental property, FreeTaxUSA has you covered. Plus, you can e-file your state tax return for a flat $14.99 fee.

What products does FreeTaxUSA offer?

Like other online e-file tax software, FreeTaxUSA has three levels of service.

- Basic: For tax filers with simple returns.

- Premium: Tax returns with itemized deductions, rental income and investments

- Self-employed: For freelancers, contractors and small business owners

While FreeTaxUSA lists three different products, they all use the same platform. The different tiers let you see how FreeTaxUSA services match up with their competitors. Unlike competing tax software programs, you don’t see annoying pop-up ads asking you to upgrade based on your answers.

Whether you have an easy or complicated return, it doesn’t matter. FreeTaxUSA charges no fees to file federal tax returns. You can also e-file state returns for $14.99.

FreeTaxUSA has three levels of customer help. Basic support via email or using the in-app support center is free. You can pay $7.99 the Deluxe edition to get live chat help. To speak with a Tax Pro via phone, chat or live screen share, opt for the $39.99 Pro Support option.

Optional services provided by FreeTaxUSA include:

- Audit Defense: Get audit assistance from an expert for $19.99. If you get hit with additional taxes, penalties or interest, a tax debt resolution expert may be able to reduce what you owe. Audit Defense covers your federal return for three years and state return for four years after you’ve filed.

- Prior year returns: If you’ve fallen behind in your taxes, you can still file returns from 2016 to 2022. Filing past federal returns is still free, but you must mail these in. State returns cost $17.99.

- Unlimited amended returns: With FreeTaxUSA, you can amend your tax returns as often as needed. If you paid for the Deluxe edition or Pro Support, you pay no fee to amend your federal return. Under Basic Support, you pay $15.98 to amend the current year or $17.97 for a prior year.

Notable FreeTaxUSA features

If you used TurboTax or H&R Block, switching to FreeTaxUSA is easy. Upload your prior year’s return; the software pulls in your information. The software automatically carries over your data, so you don’t have to re-enter it if you prepared your past return using FreeTaxUSA.

- Easy import. With its import feature, you can save time uploading your W-2 into the system. As you move the screens, the program automatically calculates your taxes as you enter data. FreeTaxUSA displays your estimated tax refund or bill on the screen. Before you file, the software checks your entries and searches for possible deductions or credits you may be eligible for. Once done, you can check over your return before sending it off.

- Investment summary allowed. Instead of listing out every trade, which you might have to do on TurboTax, you can include summaries of your 1099-B’s by brokerage and trade type.

- Maximum refund. FreeTaxUSA has a maximum refund guarantee. If you end up with a larger refund or owe less tax using another online tax program, FreeTaxUSA refunds any fees you’ve paid. Plus, you can amend your tax return for free.

- Accuracy guarantee. FreeTaxUSA has an accuracy guarantee. If you are charged penalties or interest because of a calculation error, FreeTaxUSA will reimburse you.

Risks of using FreeTaxUSA

- Less support. If you’re a TurboTax customer, you might find FreeTaxUSA to offer a bit less hand-holding, but if you are familiar with what your tax return should look like, you should be able to use it.

- State returns may not be free. Depending on the state

Is my data safe with FreeTaxUSA?

FreeTaxUSA employs several security measures to keep your personal data safe. The software encrypts your data as you enter it. FreeTaxUSA meets IRS security requirements, so your information stays safe when you e-file your taxes.

FreeTaxUSA utilizes multi-factor authentication or MFA to prevent unauthorized access to your account. You must complete a 2-step verification process to sign on, which includes a strong password and secondary verification through text, email or phone. For added protection, FreeTaxUSA sends an automatic alert whenever your login or personal data is changed, such as your password or direct deposit information.

Does FreeTaxUSA have customer support?

When stacked up against TurboTax or H&R Block, customer assistance with FreeTaxUSA seems pretty limited, unless you are willing to pay a little extra. With the Deluxe package, you can chat with a tax specialist and receive a faster response to emails for an extra $7.99. Add the Pro Support plan for $39.99 to get more personalized services like phone support, live screen share, personal tax advice, and help with your federal and state tax returns. You get unlimited amended returns with both plans.

How do I contact FreeTaxUSA?

To contact FreeTaxUSA, you can sign on to send a message through your account. No phone number is listed, but you can mail correspondence to their office in Utah.

When can you expect to receive your tax refund?

How quickly you get your refund depends on how long it takes the IRS to process your return. If you e-file and direct deposit your refund, you should see your money within 21 days. However, if you have an error in your banking information or prefer to get a check in the mail, it could be around 30 days before you get your expected refund.

If you mail instead of e-file your return, it can take at least six weeks to get your refund.