Expat Living

Living in 5 countries, including some of the most expensive cities in the world, can really mess with your mental money framework.

In Hong Kong, expats barely bat an eye at spending a few thousand dollars on rent (for a 650 square foot apartment). My ex-coworker spent $10,000 (USD) on an apartment per month, which I found insane. I’d already spent a couple years living in New York, yet Hong Kong sticker shock was at another level.

Living cheaply in Hong Kong is possible, but you live in a closet. As a single lady I survived on 330 sqr ft for a more palatable $2000/month. Granted, I also had exclusive roof access that was the same size as the apartment.. My eventual husband even moved in for a spell and we managed not to strangle each other.

Having a family changes that calculus. If you want (highly) affordable full time help, Hong Kong law requires that your helper live with you. A family of 3 plus a helper living in a 600 square foot place is not altogether uncommon. To me that’s a recipe for constant household tension, but wherever you go, you’ll find tradeoffs.

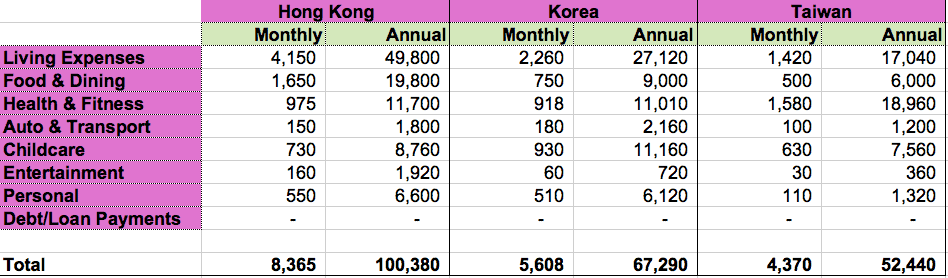

Asia Household Budgeting

An apples to apples comparison is frankly quite difficult for a household budget. Progressing through different life stages, living in various countries, and increasing income levels make comparing absolute expense numbers a bit tricky. The below chart looks at our expenses for a family of 3.

While I largely maintained the same level of personal expenses for myself despite income growth, adding a child meant larger housing, daycare, and extra discretionary spending on activities and toys. Yes a baby doesn’t have to be costly, but as a parent it’s really hard to fight the urge to create a ‘better’ environment for your child. Just wait until you have one of those buggers.

Better doesn’t have to mean more expensive, but the older I get the more I tend to save time with money.

In Hong Kong we had a higher income, high expenses, and lived centrally located. In Seoul, Korea, and Taipei Taiwan, we lived closer to the outskirts of the city. Overall there was less costly housing, social engagements, and eating out in those two cities. I’d consider living expenses in Taipei to be quite similar to Southeast Asian countries like Thailand and Vietnam.

There’s no mention of moving and settling in costs, though in Korea and Taiwan we managed to find furnished apartments. In Hong Kong we lived off Ikea furniture and secondhand FB marketplaces.

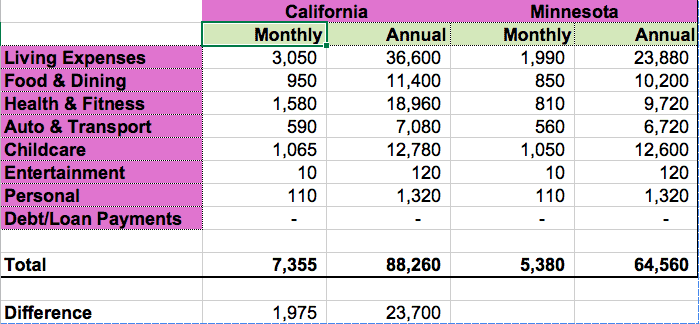

US Living Costs: Minnesota vs California

Moving to the states again was a bid for more space, better public schools, and the comforts of a fully English environment where everything was familiar. Eating healthier (or perhaps more healthily marketed foods) was also a plus.

We would have the benefit of being around family too, which when you’re raising little kids can be an absolute lifesaver. The amount of sheer energy even just one toddler requires really needs to be spread among a clan of grandparents, aunts, uncles, and friends.

With family in the suburbs of Minneapolis and Southern California, both of our choices were pretty good. Aside from the obvious weather differences, the other biggest point of comparison was living costs.

How We Determined Living Costs

Since we were on the cusp of permanently moving to either place, we did our research fully on the ground. Health insurance had to be applied for in advance anyway, so I applied and researched plans in both locations. We visited gyms, priced up daycares, visited restaurants, shopped for groceries, and went house hunting.

For those who don’t have a sense of costs before deciding on a move, there are a number of sites that compare living costs around the world:

Expense Comparison

Living costs here are basic living necessities like mortgages or rent, utilities, phone service, and internet. One note on the biggest cost, housing: As in Asia, the actual specifications were not exactly comparable, because we were willing to give up space in California for community amenities. Even with the lower housing budget in Minnesota that was for a much larger private space with yard.

Health & Fitness includes health insurance, which is actually skewed because in Minnesota I qualified for federal assistance because of pregnancy.

This is again for a frugal family of 3, with no cable television and very minimal extra expenditures For example I don’t really wear makeup or buy clothes. My husband pretty much has had a capsule wardrobe his whole life (under 30 pieces of clothing total). Our kid gets the bulk of our discretionary spending.

The decision matrix of where to live comes down to the same geoarbitrage tradeoffs we’ve faced for years. Bigger space, less city. Great weather, higher cost of living.

Where would you choose to live?

Pingback: How To Get US Health Insurance While Self Employed (Especially After Living Abroad) – FamilyFI Life