Cost: Pay a flat fee of between $2,500 and $7,500

What is Domain Money?

Domain Money is a financial planning app that aims to offer easy access to professional on-demand financial advice. Founded in 2021 and based in New York, Domain Money is a relatively newer fintech app in the market. Former Goldman Sachs Partner Adam Dell founded the company and is the CEO. Dell previously founded Clarity Money, which was acquired by Goldman.

Clients can access financial planning sessions with a Certified Financial Planner (CFP), who will help to create a financial and wealth management plan. The idea is to manage the assets for efficient tax management and wealth accumulation. As a user, you have access to a high-yield savings account and the Domain investment platform. Professionally managed portfolios focus on innovation-driven organizations.

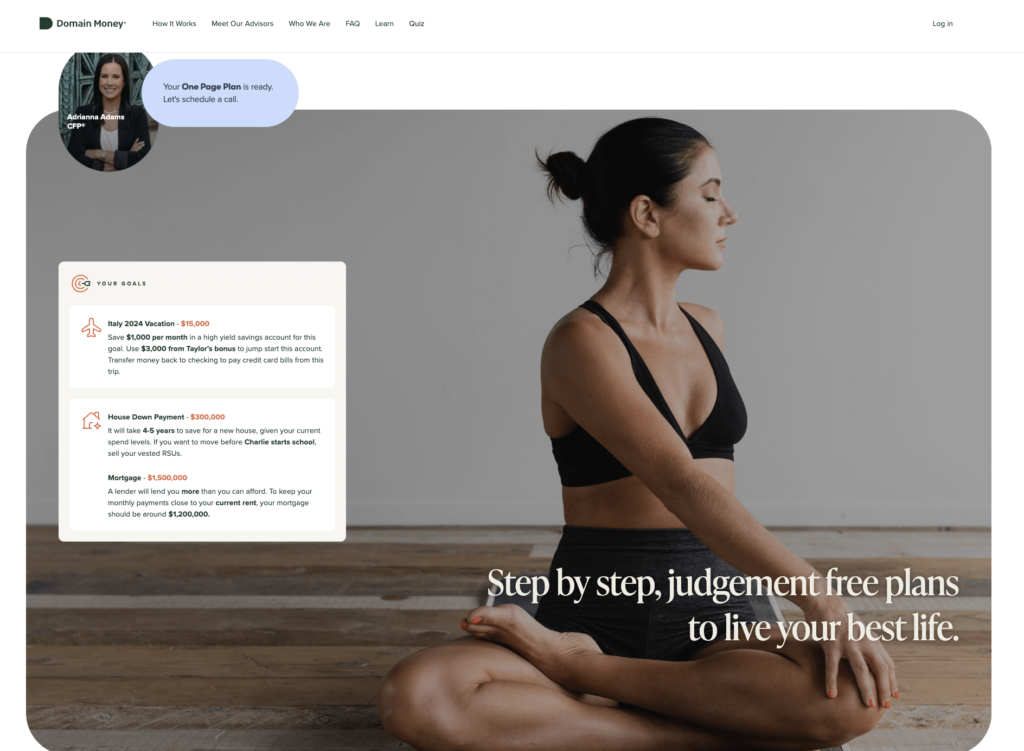

You can opt for a one-page plan. This is a short, actionable document with your current financial situation, financial plans, and actions. You will also receive personalized coaching to help you stay on track with your financial plans. You can also access several financial wellness tools to help you monitor your spending to budget and track your progress toward your financial goals.

The company invites would-be investors to receive a bird’s eye view of what to expect via online demos.

How does Domain Money work?

Here’s a quick overview of how Domain Money works:

- Introduction to your financial advisor: You connect with a Domain Money Certified Financial Planner (CFP). The CFP will question you about your financial position and strategies. The advisor aims to understand what direction you’d like to take. Use the opportunity to decide whether the app will work for you.

- Financial analysis: Your dedicated advisor will compile a picture of your current financial situation and create a plan to help you achieve your financial goals. You will receive several scenarios. You decide which investment path works best for your life.

- Financial plan implementation: Your financial planner will help you to implement your plan. They will draw up a goal-driven road map. The map will include your income, expenditure, and required savings to accomplish your goals.

- Link your bank and investment accounts to the app: After linking your accounts, the app tracks your money receipts and disbursements. You can also use the app to contact your CFP to arrange meetings.

There are three Domain Money Plans. They are:

· The one-page plan: Your CFP will spend 30 minutes with you, discovering your current financial circumstances and goals. You will upload all the required information to your financial advisor. Don’t worry your information is protected. The Domain Money server has bank-level security and bank-grade encryption. It takes three weeks to develop the one-page plan, after which you will spend an hour and a half discussing the various scenarios, outcomes, and action plans with your advisor.

· The strategic plan: If you decide to go with the strategic plan, set aside an hour to discuss your finances with your allotted advisor. Your financial advisor will draw up a plan over the next three weeks. Mail or phone your advisor as many times as you like over the month that follows your sign-up.

· The comprehensive plan: As the name suggests, this plan covers all aspects of your financial and wealth planning. Your CFP will consider your goals and set up investment, tax, and retirement savings plans. This all-inclusive plan will even go as far as estate planning. The Comprehensive Plan is a six-month process. Over the period, you will have four meetings. Your consultant will use the meetings to hold you accountable. They will also coach you through the implementation.

Whichever plan you use, your consultant will review your investments no matter where they are held, along with your savings, taxes, and insurance. Domain Money also provides online educational materials to help you understand the world of investments and wealth management. Plan updates and hour-long coaching sessions are available on demand.

Domain Money also allows investors to buy and sell stocks in cryptocurrencies and low-cost index funds from a diversified portfolio. Users have access to a reward-earning cryptocurrency credit card.

How much does Domain Money cost?

Domain Money charges a flat fee for the product. The costs are as follows:

- The One Day Financial Plan: $2,500

- The Strategic Plan: $4,500

- The Comprehensive Plan: $7,500

- Financial planning updates: $500

- Hourly coaching: $300

What sets Domain Money apart from other fintech companies?

Domain Money offers some notable benefits when compared to other fintech companies.

- It’s convenient: Domain Money is easy to access. All you need is a smartphone or laptop. Download the app from the app store, and you’re ready to start your journey.

- Domain Money Advisors: Users received customized expert advice from a certified financial advisor. Tax-efficient advice can save you money and help you to build long-term wealth. Clients all have a qualified financial consultant.

- Implementable plan: You receive a carefully thought-out wealth management plan with actionable advice on how to reach your goals.

- No management fees: Domain Money charges no management fees on investment portfolios.

- Good returns on savings accounts: The savings account returns a 6% annual percentage yield (APY). Domain Money is not a bank, so the savings account is administered through their partner, Georgia Banking Company. There is no minimum investment requirement, and the account is FDIC-insured for up to $250,000.

- Tools to help manage your wealth: Financial wellness tools help you to manage your wealth and meet your long-term financial goals. The Domain Money platform also provides proprietary software to help you prepare your tax returns.

Where Domain Money falls short

There are a few areas where Domain Money falls short. Here are some:

- Domain Money focuses on low-cost index funds. This may not suit clients with more aggressive risk profiles.

- Domain Money provides one-time plans and advice. Clients with more complex portfolios may prefer a financial advisor that offers ongoing financial advice.

- Clients who prefer face-to-face consultations may prefer not to rely on technology.

Who should use Domain Money?

Domain Money targets young people starting out or in the mid-career phase of their lives. The plans are designed for people serious about financial planning and wealth management.

If you’re comfortable with online tools and appreciate convenience, you’ll love Domain Money’s user-friendly interface and mobile access.

If you’re just starting your financial journey and need guidance on setting goals, managing your budget, and investing, Domain Money’s one-time planning session and financial tools can provide a valuable foundation on which to build your goals.

Who shouldn’t use Domain Money?

If you have a high net worth, a complex financial situation, or require more personalized investment strategies, you may benefit from continuous financial advice. Domain Money’s one-time financial planning session may not work for investors who need ongoing guidance as their financial plans evolve.

If you aren’t comfortable using technology or have limited access, Domain Money’s app-based platform may not suit you. Equally, if you value personal interaction, you may prefer face-to-face meetings.

How to obtain Domain Money Advice

Signing up for Domain Money advice is quick and easy. All you have to do is visit the web site and register for your first consultation. It is free of charge. The consultant will spend some time finding out your current situation and future financial plans. If you don’t believe the Domain Money app can help you with your wealth management, you have no obligation to continue.

If you decide to continue your relationship with Domain Money, you will upload all relevant documents and wait for your financial advisor to draw up a plan of action. You will make an appointment to discuss your preferences and your implementation plans

How does Domain Money stand up against the competition?

Let’s compare Domain Money with the opposition.

Wealthsimple

Wealthsimple is an online investment platform, that offers accessible, convenient investments. The core service is an automated robo-advisor. You answer a questionnaire about your financial goals and risk tolerance, and the algorithm builds a personalized portfolio of low-cost, globally diversified ETFs. It also has a self-directed trading platform for clients to access stocks, ETFs, and fractional shares.

The business charges a flat annual management fee based on your investment amount and account type. There are three different account options to choose from.

Betterment

Betterment is an automated builder of investment portfolios driven by financial experts. The platform offers a portfolio of investment options, all offering tax-efficient investment advice. Betterment provides a cash management system for the clients’ daily banking needs. The savings account will pay an APV of 4.75%. You can also set up your IRA or Roth IRA through Betterment. When you subscribe to Betterment, you’ll pay a monthly fee of $4.

Quantbase

Quantbase is a digital investment product that uses algorithms and machine learning to manage investments and adjust portfolios. The robo-advisor is registered with the Securities Exchange Commission, so it is secure.

The Quantbase platform is easy to navigate and user-friendly. The investment models are, however, complex with high-risk potential. Quantbase charges $5 monthly for accounts of under $6,000 and a 1% management fee for larger accounts.

Is Domain Money a good fit for you?

If you’re a Millennial looking for advice on how best to manage your finances and achieve your financial goals, Domain Money may provide the advice you’re looking for. You also have access to their savings account. It offers an SVA of 6%, a good rate of interest. Use the app to invest in a range of securities and cryptocurrencies, earning rewards from the crypto credit card.

On the other hand, people who have complex portfolios or prefer face-to-face contact and regular meetings may find that Domain Money is not a good fit.

FAQ

What is the interest rate for Domain Money?

The Domain Money savings account use to return 6% but is now at a 4% APY and subject to change.

Is Domain Money legit?

Although Domain Money is relativelynew on the market, it is a legitimate financial planning business.

Who are some of the Domain Money investors?

Key partners include Valor Capital Group, SVA, Maveron, SV Angel, Bessemer Venture Partners, and RRE Ventures.