Investment decisions can be fraught with emotions, leading to less-than-ideal outcomes. So why not put your trust in the impartial guidance of robo-advisors? Say goodbye to uncertainty and let technology drive your financial success!

Meet Betterment, your digital money guru who merges advanced tech designed with human expertise to transform your finances. Betterment’s specialty? Crafting and managing your investment portfolio exactly how you want it. But it’s not just about investments; Betterment offers savings, spending, budgeting, and even retirement planning guidance.

This Betterment review aims to highlight its capabilities, presenting both its advantages and disadvantages. Doing so lets you weigh whether Betterment’s approach suits your financial needs.

At a glance: Betterment pros and cons

Pros:

- Low-cost investing and financial planning services

- Different portfolio management strategies to choose from

- No account minimums or additional trading expenses, and low expense ratios

- Fractional share investing, which allows you to buy and sell fractions of a share of an ETF

- Easy to use, affordable, and accessible for everyone

Cons:

- No direct indexing, alternative assets (except for cryptocurrencies), or individual asset trading

- Higher fee for access to human advisors

- Emergency fund portfolio may carry too much risk

What is Betterment?

Betterment is a robo-advisor providing automated investing and financial planning services. Using modern portfolio theory and behavioral economics, it curates and manages your portfolio, primarily comprising low-cost exchange-traded funds (ETFs) tracking diverse stock and bond indexes. This platform continually adjusts your portfolio allocation to align with your risk tolerance and goals.

However, it’s more than just an investment platform. Betterment extends its services to encompass tools and features for savings, spending, budgeting, and comprehensive retirement planning.

How does Betterment work?

Betterment operates by gathering information about your age, income, net worth, goals, and risk tolerance. Using these details, it tailors a recommended portfolio suited to your preferences and personal circumstances. You can further personalize your portfolio by choosing core, smart beta or socially responsible investing strategies and adjusting the stock-to-bond ratio. After finalizing your preferences, you can fund your investment account through bank cash transfers, direct deposits, or rollovers from other accounts.

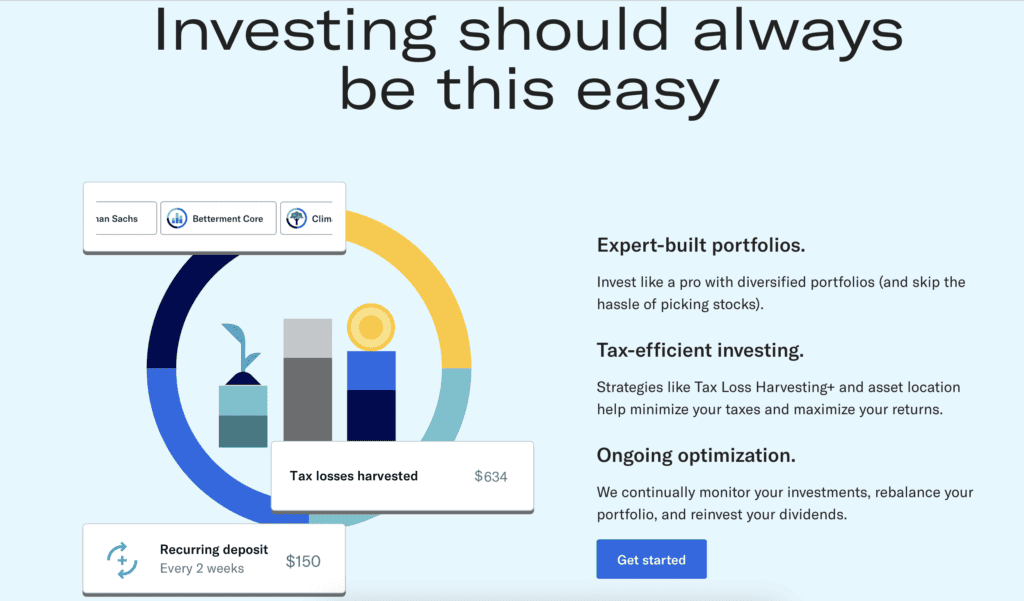

The platform then invests your funds in a selection of ETFs matching your portfolio allocation. Betterment continuously monitors and rebalances your portfolio to ensure alignment with your goals and risk tolerance. You retain the flexibility to modify goals and portfolio settings anytime, with Betterment updating your portfolio accordingly. Additionally, withdrawals are penalty-free and unrestricted.

Betterment provides a dashboard displaying your portfolio performance, goal progress, and projected returns. This dashboard grants access to cash management accounts, tax optimization tools, and financial advice, offering a bird’s-eye view of your financial landscape.

How much does Betterment cost?

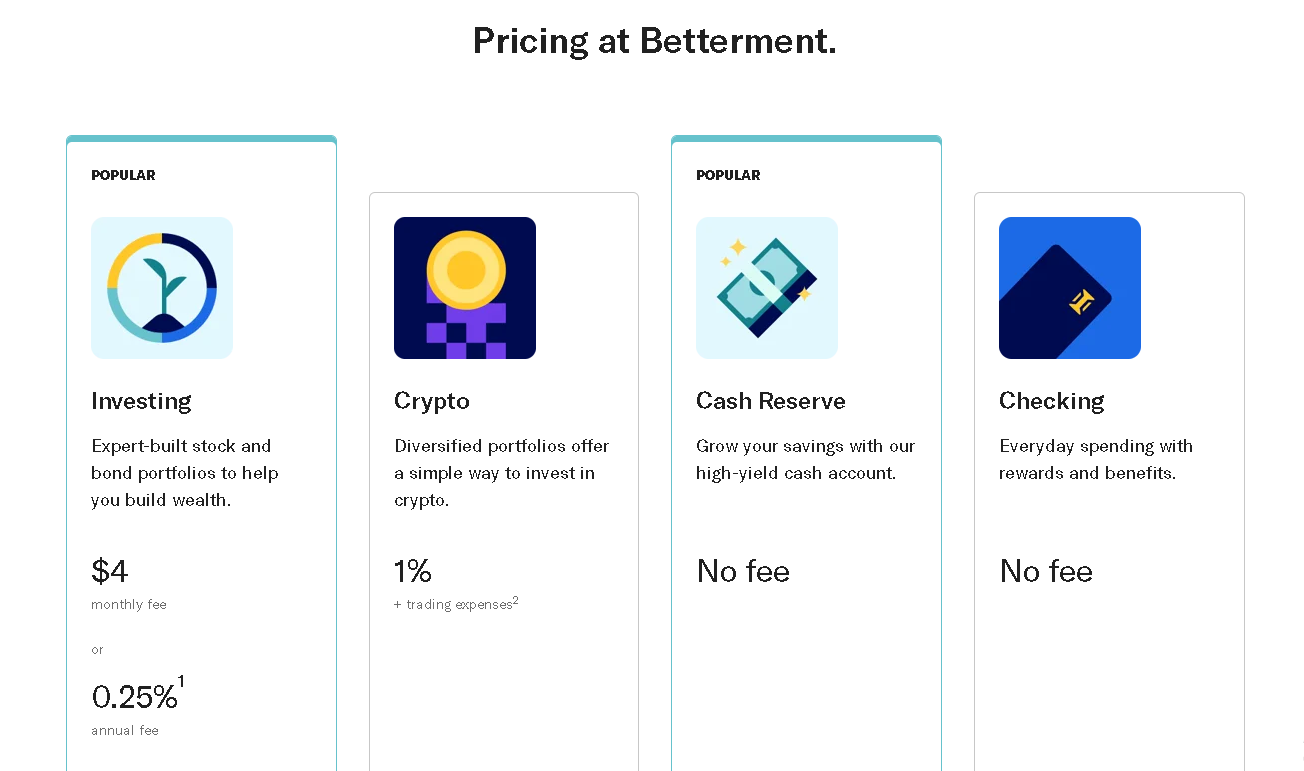

Betterment has two plans with tiered advisory fees: the basic at 0.25% annually (investment accounts with less than $20,000 are charged $4 monthly) and the premium at 0.40%.

The basic plan covers automated investing and financial tools without minimums or extra charges for services like tax-loss harvesting. The premium plan includes everything from the basic plan and gives access to certified financial planners for personalized advice, but comes with a $100,000 minimum account balance requirement.

Image Source: https://www.betterment.com/pricing

Betterment key features

Betterment platform offers a number of features and tools that make it stand out from other robo-advisors and online platforms.

Comprehensive portfolio mix

Betterment provides a diversified portfolio mix across several asset classes and individual securities. Its core portfolio strategy includes various US and international stock and bond categories, aiming for global exposure while minimizing costs and taxes.

The socially responsible investing strategy aligns with ESG values, replacing some core ETFs with those focusing on positive societal and environmental impacts, albeit with slightly higher expense ratios.

Its Smart beta portfolio strategy enhances returns using factor-based Goldman Sachs Smart Beta ETFs, emphasizing value and low volatility with higher potential risks and costs.

Betterment also allows limited investments in cryptocurrencies like Bitcoin, Ethereum, and other established coins, for select account types.

Match your investing to your goals

Betterment enables users to set multiple financial goals, including subgoals like retirement, travel, or education, tailoring portfolio allocations and monthly contributions based on individual needs and preferences. By answering goal-specific questions, Betterment offers recommended portfolio allocations, contribution amounts, and projected outcomes while continuously tracking progress and providing advice for success. Users can sync external accounts to comprehensively view their net worth and cash flow and optimize investment portfolios and tax strategies across all accounts for holistic financial management.

Affordable for any investor

Betterment stands out for its affordability, with no ongoing minimum investment account balance, account, low fees, and free withdrawals. ACH deposit minimums are $10, and note that there may be portfolio specific minimums to be fully invested or enable rebalancing. It offers a basic investing plan with annual fee of 0.25% and a premium plan at 0.40%, with ETF expense ratios ranging from 0.05% to 0.18%, on average (as of September 2022). Betterment also charges a 1% annual fee on it cryptocurrency offerings.

Hefty tax management tools

Betterment provides tools to optimize tax efficiency and increase after-tax returns. Tax-loss harvesting automatically sells losing investments to offset gains, potentially boosting returns. The tax-coordinated portfolio strategically allocates assets across account types to minimize taxes. Smart beta portfolio strategy, using factor-based Goldman Sachs Smart Beta ETFs, aims to enhance returns and diversify portfolios, while offering tax benefits by reducing turnover and capital gains distributions.

Fractional share investing

Betterment offers fractional share investing, enabling investment in ETFs with as little as $10, lowering barriers to entry and improving diversification by allowing balanced investment portfolios across multiple asset classes. This feature reduces cash drag, ensures full investment utilization, and enhances tax efficiency by facilitating precise share selling for portfolio rebalancing or tax-loss harvesting.

Cash management accounts

Betterment offers two cash management accounts:

- Betterment Cash Reserve: A high-yield savings account providing up to 4.75% APY with FDIC insurance up to $2 million at program banks. This rate is generally higher than the average annual percentage yield on other accounts. This account is suitable for saving for goals and earning interest on idle cash, offering easy transfers between accounts.

- Betterment Checking: A fee-free account with no minimum balance and worldwide ATM fee reimbursements, facilitates purchases, bill payments, money transfers, and check deposits. It’s secured with FDIC insurance of up to $250,000 of FDIC insurance through nbkc bank (member of FDIC) and offers features like spending alerts and financial advice. You can access money using the Betterment Visa debit card.

Where Betterment falls short

Betterment shines with its array of features, yet it’s not without its quirks.

Access to a financial advisor costs extra

Betterment offers financial advice through its premium plan, granting unlimited access to certified financial planners or via one-time advice packages tailored to specific life events. However, these options come at a higher cost, with the premium plan charging 0.40% yearly (0.15% more than the basic plan) and requiring a $100,000 minimum balance. At the same time, one-time advice packages range between $299 and $399, making it pricier than other robo-advisor options offering free or lower-cost human advisors access like Wealthfront, Personal Capital, or Vanguard Personal Advisor Services.

Emergency fund portfolio may carry too much risk

Betterment’s emergency fund option is a bond-heavy mix, potentially subjecting it to market risk despite a low probability of significant losses. While Betterment aims for stability, withdrawing during downturns might impact financial security. Consider other robo-advisors like Wealthfront with a market risk-free cash account up to 5% APY.

Premium tools carry a higher price tag

Betterment’s premium tools, like smart beta and alternative assets, incur higher annual fees and expense ratios than its core portfolio strategy, potentially impacting returns. While these tools offer enhanced diversification and control, they come at an increased cost, eating into potential returns.

No direct indexing

Betterment doesn’t provide direct indexing, a feature available in robo-advisors like Wealthfront and Personal Capital. Direct indexing allows owning individual stocks instead of ETFs, potentially reducing costs, increasing tax efficiency through loss harvesting, and enabling portfolio customization.

No margin trading/alternative assets/individual asset trading

Betterment doesn’t support margin trading, alternative assets beyond cryptocurrencies, or individual stock/ETF trading, focusing on long-term, diversified investing. For those seeking leverage, variety, or flexibility, consider platforms like Robinhood, which offers margin trading, alternative assets, and individual asset trading, or Interactive Brokers, which provides a range of features, including margin trading and a broader asset selection.

Performance

It might be easy to look at performance and try to compare it to the equity market performance. It’s not going to beat the equity market, however, because the Betterment core portfolio is a diversified portfolio with lower risk. In recent years the S&P 500 benchmark equity index has done really well, so if you try to compare it to that, the Betterment portfolio might not measure up. But in a way that’s comparing apples to oranges.

Who should use Betterment?

Betterment caters to investors seeking straightforward and cost-effective financial planning, ideal for those:

- Seeking an uncomplicated approach to investing and financial planning, valuing simplicity and ease.

- Comfortable with automated, hands-off investment strategies, not requiring extensive portfolio customization.

- Desiring a diverse portfolio including options for socially responsible or factor-based investing.

- Interested in accessing cash management accounts, tax optimization tools including tax loss harvesting, and financial guidance within a moderate budget, willing to pay a flat annual fee for these services.

Who shouldn’t use Betterment?

Betterment isn’t ideal for investors seeking to manage or trade their portfolios actively, requiring extensive customization, or desiring direct indexing, alternative assets, or leverage through margin trading. Additionally, it may not suit those with a higher budget, preferring a fee structure that’s lower or variable.

How to open a Betterment account

Betterment offers various account types:

- Investing accounts (taxable and tax-advantaged)

- Cash management accounts (Cash Reserve and Checking)

- Advice packages for one-time financial guidance

There are no account minimums for investing or cash management accounts and you can start investing with just $10. You can also open joint accounts for shared goals, though the other individual needs to open an individual Betterment account first.

To open an account, sign up by providing basic details, answer queries about your financial situation, customize your portfolio preferences, fund your Betterment account (starting from $10), and allow Betterment to manage your investments in line with your goals and preferences without withdrawal penalties or fees.

Betterment vs. competitors

Betterment is one of many robo-advisors in the market, and it faces stiff competition from other platforms that offer similar or different features and benefits. Here are some of the main competitors that Betterment compares to and how they stack up against each other:

Betterment vs. Wealthfront

Wealthfront, a robust robo-advisor like Betterment, shares commonalities such as a 0.25% basic plan fee, absence of account minimums and trading fees, along with features like tax-loss harvesting, goal setting, and portfolio performance tracking.

However, distinctions exist: Wealthfront offers direct indexing for accounts over $100,000, a cash account with 5% APY and no market risk for emergency funds, and a comprehensive financial planning tool called Path. Yet, it lacks access to human financial advisors, socially responsible or factor-based investing options, and has fewer portfolio choices than Betterment.

Setting up joint accounts is a little bit easier with Wealthfront because they do not require individual accounts setup first whereas Betterment requires each person to open an individual account, though it does not have to be funded. The individual account can be closed once the joint account is setup, but this creates an additional step.

Betterment vs. Empower

Empower (formerly Personal Capital), focusing on high-net-worth individuals, parallels Betterment by providing automated investing, financial planning tools, access to live advisors, and cash management accounts without fees.

Empower’s fees range from 0.49% to 0.89%, depending on account size. However, you can only get the full range of Empower’s offerings with a minimum investment of $1,000,000, which includes access to a CFP.

Betterment vs. M1 Finance

M1 Finance and Betterment share similarities in offering automated investing, cash management accounts, and access to human financial advisors. However, M1 Finance diverges by not charging an annual fee for its basic plan. It also provides a premium plan, M1 Plus, for $10 monthly (free for the first 3), featuring added perks like lower borrowing rates and more trading windows.

With a low account minimum of $100 for taxable accounts and $500 for tax advantaged retirement accounts, M1 Finance emphasizes customization by enabling users to create their portfolios from thousands of stocks and ETFs, use fractional shares, and access M1 Borrow for loans up to 40% of their portfolio value at low-interest rates. Nonetheless, M1 Finance lacks socially responsible or factor-based investing options, has fewer portfolio strategies, and does not offer tax optimization tools compared to Betterment.

Betterment Review: is it worth the hype?

Betterment investing is like that friend who’s pretty awesome but not flawless—think superhero with a tiny cape snag. It’s fab for those who want a breezy, hands-off investing ride, offering a buffet of asset classes and tools for all things finance, from budgeting to retirement plans. But it’s missing a few superhero moves—no direct indexing or alternative assets, just crypto—plus, their emergency fund might be a bit more of a rollercoaster than a safety net. Still, with over $40 billion in assets managed and a user-friendly vibe, it’s like having a reliable sidekick on your financial journey.

FAQs

Is Betterment legit?

Yes, Betterment is a legitimate investment service and robo-advisor that has operated since 2008.

Is it safe to invest with Betterment?

Betterment takes security seriously and uses industry-standard security measures to protect your account and personal information. However, all investments come with risks, and it’s essential to do your research before investing.

Can you make money from Betterment?

Yes, it is possible to make money from investing with Betterment. However, it’s important to remember that all investing involves risk, and there are no guarantees of returns.