You don’t want to pay more for something than necessary when money is tight. With tax time here, you can hold onto more cash when you file your own return. Whether your taxes are simple or complicated, filing fees are generally less than what you’d pay someone to do this for you. Plus, you can e-file your return and get your refund quicker.

So, if you are comfortable enough to take the plunge and file your taxes online, check out E-File.com.

Who Is E-File Best For?

E-File is a good option if you want to save money by filing your tax return. While its software may seem a bit on the simple side, you aren’t paying for all the bells and whistles you get with competing online tax packages. With a basic federal return, you can file for free. Even if your taxes are a bit more complicated, you’ll likely pay lower filing fees than with TurboTax or H&R Block.

E-File feels a little skimpy on the customer support side compared to its peers. However, if you are comfortable enough flipping through the screens on your own, E-File may be best for you.

Key features

Filing taxes on your own may be easier than you expect. With E-File, you get a user-friendly site with an affordable price tag. The program offers helpful prompts to guide you through the necessary forms. If you know your way around, you save time with a self-guided experience.

E-File saves your spot if you need to pause to gather certain information. Based on the information provided, E-File calculates your tax position in real-time.

Nervous about entering personal information online? E-File keeps your details safe using multi-factor authentication. Plus, the software encrypts your data when e-filing your return.

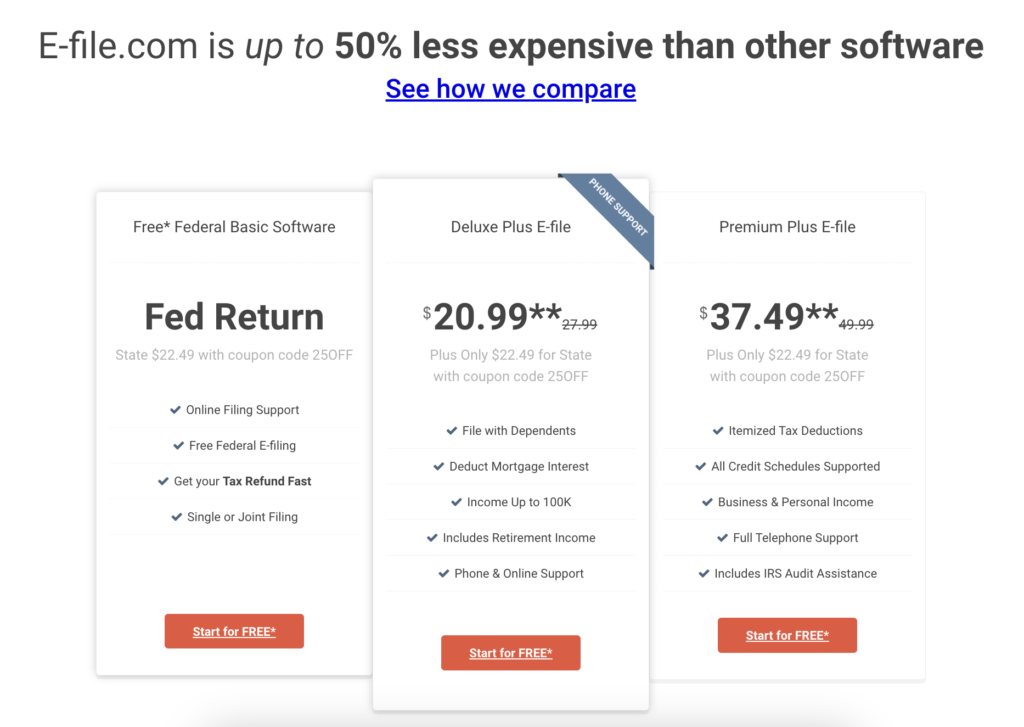

E-file.com Plans And Pricing

Free Federal Basic

With the Free Federal Basic package, you can pay no federal filing fees for a simple tax return. Single and married filing joint taxpayers earning less than $100,000 from wages, unemployment income, or tips qualify for this plan. The Basic package comes with online support.

Deluxe Plus E-File

The Deluxe Plus E-File tier handles expanded tax needs. Use the Deluxe plan if you have retirement income, mortgage interest, or claim a credit for dependents. Like the Basic tier, your income must be less than $100,000 to file.

The Deluxe plan costs $27.99 and includes phone and online help. Even if you don’t need the other services the Deluxe plan offers, it’s still a good option if you like the comfort of having a phone number to call for help.

Premium Plus E-File

Choose the Premium Plus E-File plan when your taxes are more complicated or you have income over $100,000. The Premium plan supports such tax needs as itemized deductions, investment income, self employment income, credits and business income. The$49.99 price tag gets you access to these expanded tax features, plus full telephone and IRS audit support.

E-File strengths and weaknesses

When you are searching for the best software to file tax returns online, E-File has plenty of strengths you can check off your list.

- Simple interface

- Safe and secure

- Affordable

Yet, no e file tax software is perfect, so there are some drawbacks to consider when using E-File.

- No free state filing

- Limited customer support

- Cannot upload documents

Simple Tax Software

Using E-File.com is as simple as answering questions. Once you create a free account, you provide your personal information and details about how much you earn and what you can deduct.

If you have a pretty good idea about filing taxes, you can jump around to the different forms. Yet if it’s your first time or you just like a more systematic approach, the guided question-and-answer approach helps you move through the site.

The software calculates your refund or taxes due. Then, you can decide whether to e-file or mail your tax return.

Safe and Secure Connection

E-File takes many steps to keep your data safe. The company uses multi-factor authentication, 256-bit data encryption technology, and a secure connection.

Affordable

Perhaps E-File’s best feature is its price tag. Most customers can take advantage of the free basic plan and pay nothing to file. Should you go with the Deluxe or Premium service you’ll still pay less than most leading competitors.

No Free State Filing

Even if you don’t pay to file your federal tax return, E-File does charge $29 to file state returns. The good news is that the fee covers multiple states. So you aren’t charged more money if you have to file in more than one state. Plus, you may land a discount on state filing fees from E-File if you prepare your returns early in the season.

Have a really, really simple tax return? Like a “W-2 and standard deduction” simple tax return? You may be better off filing through TurboTax or H&R Block. Both companies offer free e-filing for federal and state returns for simple returns.

Limited Customer Support

E-File isn’t known for its robust customer service. Support isn’t a big deal when you have an easy tax return. Yet when your taxes are more complicated or you just like having someone close by if you have questions, you can pay for extra phone or online support.

Keep in mind that if you get stuck and want someone to take over filing your federal taxes, E-File doesn’t offer that service. Instead, look to TurboTax or H&R Block to have your tax returns prepared by a tax professional.

No Document Upload

Since E-File has no document upload features, you must manually key in certain information from your IRS tax forms. It’s not a big deal when you only have a few IRS documents. However, the process becomes time-consuming if you need to input data from a prior year’s tax return or have multiple W2s.

E-file.com Reviews

Overall, E-File customers are happy with the company. The service reviews average a 4.5 out of 5-star rating on Trustpilot. The Better Business Bureau (BBB) gives the company an A+ rating. Users often rave about its free filing and how easy it is to prepare taxes.

Customers generally found it easy to get help when needed. A mistake can happen when you file online, but most filers can easily find the answers online or by contacting tech support.

Does E-file.com Make Tax Filing Easy In 2024?

E-File makes tax filings easy in 2024. Just set up a free account and follow the steps. Once you review your return, you can e-file to get your refund faster. If you make a mistake and the IRS rejects your return, you can fix and resubmit it for no extra charge.

Compare eFile

How does E-File stack up against its leading competitors?

E-file.com vs Turbo Tax

Turbo Tax is an established leader in online tax preparation. TurboTax has a user-friendly platform and guarantees the accuracy of its calculations. Like e-File.com, TurboTax offers different tiers of services based on how complicated your taxes are.

You may even qualify for free federal and state tax filing with a simple tax return. If you have only a W-2 from your employer and plan to take the standard deduction, you could file for free. However, TurboTax quickly becomes more costly than E-File if you earn money on the side, have an unemployment income, or upgrade to maximize deductions.

E-file.com vs FreeTaxUSA

Staying true to its name, FreeTaxUSA really is free. Whether your taxes are simple or complicated, your federal return is always free. Like E-File, FreeTaxUSA keeps its platform simple and costs low. FreeTaxUSA charges a flat $14.99 fee for state returns. If email or in-app support isn’t your thing, you can pay $7.99 for live chat or upgrade to get personalized advice from a Tax Pro for $39.99.

Consider your tax needs when choosing between the two. While FreeTaxUSA costs less, E-File may be more economical if you file multiple state returns. If you are more comfortable handling your taxes knowing you can reach out to a Tax Pro, FreeTaxUSA may be the better option.

E-File.com Makes Filing Taxes Easy and Affordable

E-File.com is an economical way to file taxes when affordability tops your list. The website is user-friendly and easy to navigate. You pay only for the services you need and might even file for free. Yet even if you don’t qualify for free filing, E-File’s paid plans typically cost less than competing online tax programs.

FAQs

How Do I Contact The E-file.com Support Team?

You can contact support through your account on the E-File website. You get full telephone support when you opt for the Deluxe or Premium plan.